Bitcoin ETFs See Major Outflows as BTC Price Dips to $108,000

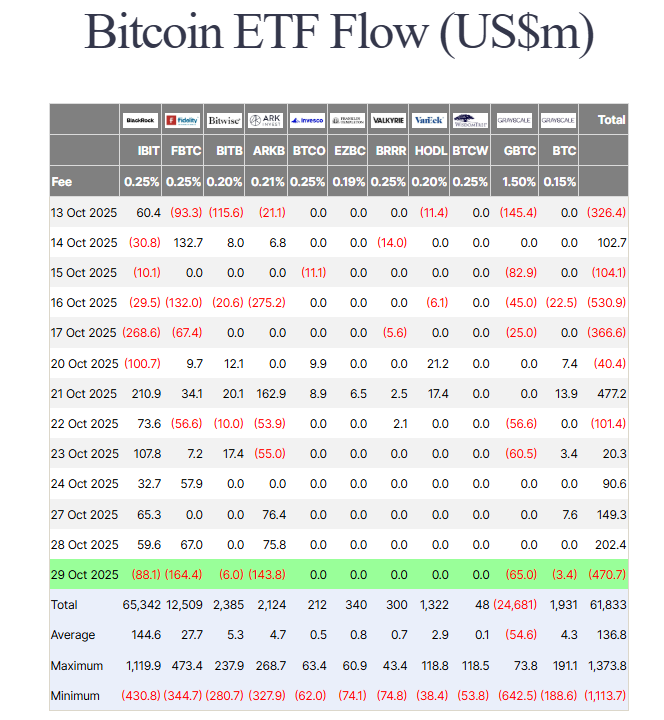

US-listed spot Bitcoin exchange-traded funds (ETFs) shed $470 million on Wednesday as the price of Bitcoin briefly fell to $108,000 before recovering, according to data from Farside Investors.

Fidelity’s FBTC led the exodus with $164 million, followed by ARK Invest’s ARKB, which saw a pullback of $143 million. BlackRock’s IBIT rounded out the top three with $88 million in outflows.

Grayscale’s GBTC also recoded $65 million in outflows, while Bitwise’s Bitcoin ETF BITB saw a relatively minor loss of $6 million.

The drawdown has come after a few days of steady gains, with $149 million on Monday and over $202 million on Tuesday.

The outflows have also reduced cumulative net inflows to $61 billion, and total assets under management have declined to $149 billion, representing 6.75% of Bitcoin’s (BTC) market capitalization, according to crypto investment research platform SoSoValue.

Bitcoin price feels pressure after rate cut

The price of Bitcoin has been drifting between $108,201 and $113,567 for the last 24 hours, according to CoinGecko.

It fell despite the US Federal Reserve decision to cut interest rates by 25 basis points, but it appears to have gained after a meeting between US President Donald Trump and Chinese President Xi Jinping, where they discussed trade tensions between the two countries.

Related: OG Bitcoiners are rotating out, but it’s a healthy dynamic: Analysts

ETFs still hold the bulk of Bitcoin

In the past, analysts have told Cointelegraph that flows into ETFs are linked to the token’s price, with a rally in early October stemming from large inflows into the investment vehicles.

Despite the outflows, ETFs still hold more than 1.5 million Bitcoin worth $169 billion, representing 7.3% of the total supply, according to Bitbo.

BlackRock’s IBIT leads the pack with 805,239 Bitcoin, Fidelity’s ETF is in second place with 206,258, and Grayscale’s GBTC has the third-largest holdings of tokens with 172,122.

Meanwhile, Michael Saylor, the co-founder of MicroStrategy, isn’t concerned about price volatility, making a bullish forecast on Monday that Bitcoin will still hit $150,000 by the end of 2025 due to positive developments in the space.

Magazine: Mysterious Mr Nakamoto author: Finding Satoshi would hurt Bitcoin