RWAs to give the timber industry new routes to capital — Here’s how

Sponsored Content

Disclaimer.This content is part of a paid partnership. The text below is a sponsored article that is not part of Cointelegraph.com editorial content. The material is written by our advertorial team and has undergone editorial review to ensure clarity and relevance, it may not reflect the views and opinions of Cointelegraph.com. Readers are encouraged to conduct their own research before taking any actions related to the company. Disclosure.

Born as a technology to facilitate payments, blockchain has the potential to go far beyond simple finance. Tokenization is a promising use case to realize that potential. It allows carrying real-world assets (RWAs) — like property, commodities or artwork — onchain, and creates an additional market where these assets can be traded.

With tokenization, RWAs can move on global, always-on, onchain rails instead of slow, local systems that are subject to working hours. Trading costs decrease, and settlement becomes more predictable, making it easier to open and close positions. The result is enhanced liquidity for the tokenized asset.

Yet, the current landscape presents some challenges that hinder mass adoption among institutional players. Institutions need clear answers on what each token actually entitles them to in legal terms, who is responsible for maintaining the underlying asset’s performance, and what happens if any party in that chain fails.

Answers to these questions vary heavily in each jurisdiction. Some jurisdictions have already established regulatory frameworks that cover tokenized assets, but applying them across borders means reshaping structures and processes for each market. This piecemeal compliance often relies on separate local issuers or servicers, which keeps counterparty risk in focus even when the underlying asset looks sound.

Timber industry remains underfunded

Solving such challenges can prove especially beneficial for the timber industry. Timber production cycles are long: trees grow for years, then pass through sawing, drying and manufacturing before they become saleable outputs. Banks are often reluctant to provide loans that match those timelines as they favor short-term loans, and this leaves producers with costs piling up long before the final product is sold. Many sit on forests and stock they know will find buyers, but cannot easily turn that future income into cash when they need to pay for land, labor and equipment.

The annual funding gap for the industry currently stands at $423 billion. Analysts expect the demand for timber to quadruple by 2050. So, creating suitable financing for the industry is an increasingly pressing matter.

RWAs can ease this pressure by giving those future cash flows a form investors can actually hold and trade. Instead of relying only on a bank loan, a forest owner or mill can issue onchain claims tied to clearly defined revenue streams. Investors who are comfortable locking up funds for longer can buy and hold, while others can exit earlier by selling their tokens to new entrants.

RWA model matches timber cycles

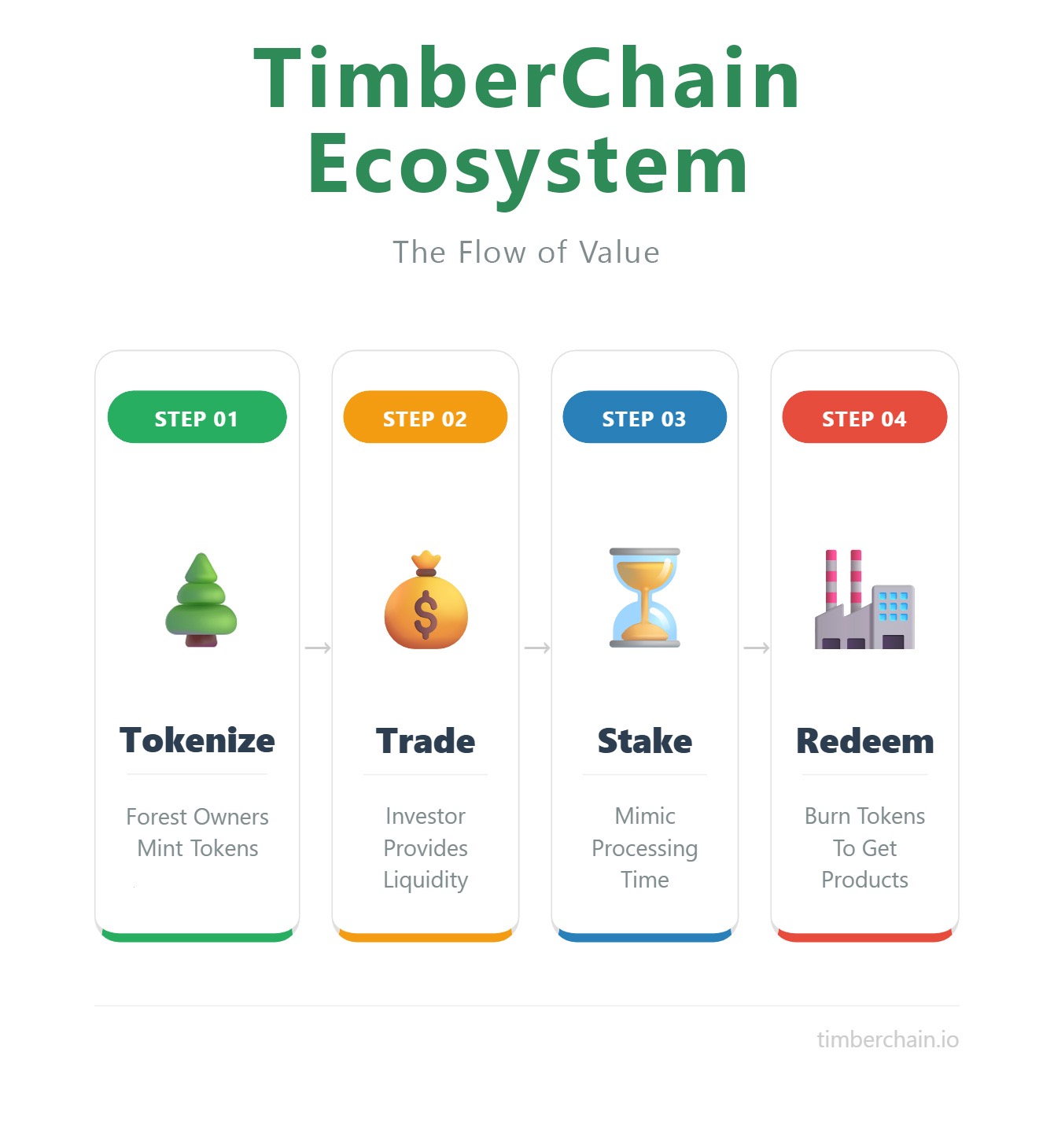

Recognizing the potential for improvement, TimberChain is developing an RWA platform specifically designed for the timber industry. The platform will allow forest owners and other stakeholders in the space to tokenize and trade their stock onchain.

Contrary to traditional funding models that ignore the conditions in long production cycles, TimberChain’s economic model reflects how value is created in the timber industry. Its staking mechanics match digital lockups with physical processing times. Staking pools are set for periods such as six to twelve months, which mirrors the timeline of steps like kiln drying.

The incentives are also tied to physical reality. During its journey from raw log to dried timber, the value of wood increases around 3-4 times. Staking on TimberChain reflects this appreciation; locking for the full period staking incentives that follow this increase in value.

TimberChain alleviates concerns about regulations by providing a platform that complies with the EU’s Markets in Crypto-Assets (MiCA) framework. MiCA requires clear answers on what each token represents, how it is backed and who stands behind it through detailed white paper and governance requirements. This allows the tokenized timber industry to operate fully compliant in the entire union.

TBR26, the platform’s native token, stands at the heart of the project. It will function as a unit of account redeemable for physical wood products and offer the liquidity the timber industry needs.

Sustainability is a consideration

Climate change is a thought-of aspect in TimberChain’s model. With this model, small forest owners receive access to more liquidity, meaning they can spare more resources to sustainable forestry practices, which are often neglected due to cash flow pressures.

TimberChain also plans to integrate carbon credit markets by 2028. Carbon credits will create additional value streams for players in the industry while enabling them to stay committed to green causes.

A platform for green asset derivatives

TimberChain shows how RWAs can be structured to accommodate a long-cycle, asset-intensive industry that is often underfunded by legacy systems. That means timber can be treated as an asset class planned around long horizons rather than surviving from one financing round to the next.

Over time, TimberChain aims to become the standard for green asset derivatives, demonstrating that crypto rails can support asset-backed, MiCA-compliant products that facilitate long-term finance for real industries, rather than short-lived narratives.

Disclaimer.This content is part of a paid partnership. The text below is a sponsored article that is not part of Cointelegraph.com editorial content. The material is written by our advertorial team and has undergone editorial review to ensure clarity and relevance, it may not reflect the views and opinions of Cointelegraph.com. Readers are encouraged to conduct their own research before taking any actions related to the company. Disclosure.