Strategy Adds $99.7M Bitcoin Amid Multi-Week Price Surge

Michael Saylor’s Strategy, the world’s largest corporate Bitcoin holder, added more BTC to its balance sheet last week as the US Federal Reserve cut interest rates for the first time this year.

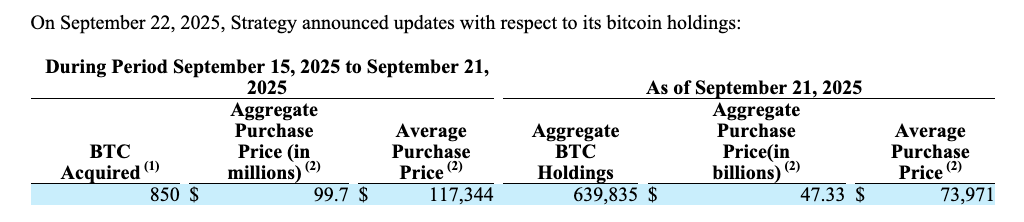

Strategy acquired 850 Bitcoin (BTC) for $99.7 million during the week ending Sunday, according to a US Securities and Exchange Commission filing on Monday.

The purchase was made at an average price of $117,344 per coin as BTC briefly surged to multiweek highs above $117,000 last Thursday following the Fed’s 25 basis point interest rate cut, according to CoinGecko data.

The acquisition brought Strategy’s total Bitcoin holdings to 639,835 BTC, purchased for about $47.3 billion at an average price of $73,971 per coin.

Ongoing buying slowdown as Bitcoin goes “boring”

Strategy’s latest Bitcoin purchase continues the trend of modest acquisitions, highlighting a slowdown compared with the large buys seen earlier this year.

So far in September, Strategy has acquired 3330 Bitcoin, a sharp decline from the 7,714 BTC bought in August — itself down 75% from July’s 31,466 BTC.

Saylor, who is known for his commitment to buy more Bitcoin at higher prices, has made some remarks on the limited volatility of Bitcoin observed in the past months amid growing institutional adoption.

“The conundrum is, well, if the mega institutions are going to enter, if the volatility decreases, it is going to be boring for a while, and because it’s boring for a while, people’s adrenaline rush is going to drop,” he said in an interview last week.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea