Bitcoin Metrics Say $112K BTC Could be the Bottom

Key takeaways:

-

Positive Coinbase Premium Index signals strong US retail demand buying the dip.

-

Strong ETF inflows and Bitcoin treasury companies bolster BTC’s recovery potential.

-

Despite aggressive short-side pressure, the risk of another liquidation event is decreasing.

Bitcoin (BTC) fell from its monthly high of around $118,000, dropping as much as 5.5% to today’s intraday low of $111,571. While this is only a 10.4% drawdown from the $124,500 all-time high, several metrics suggest that the price range between $112,000 and $111,500 could be the new bottom range before BTC recovers to new highs.

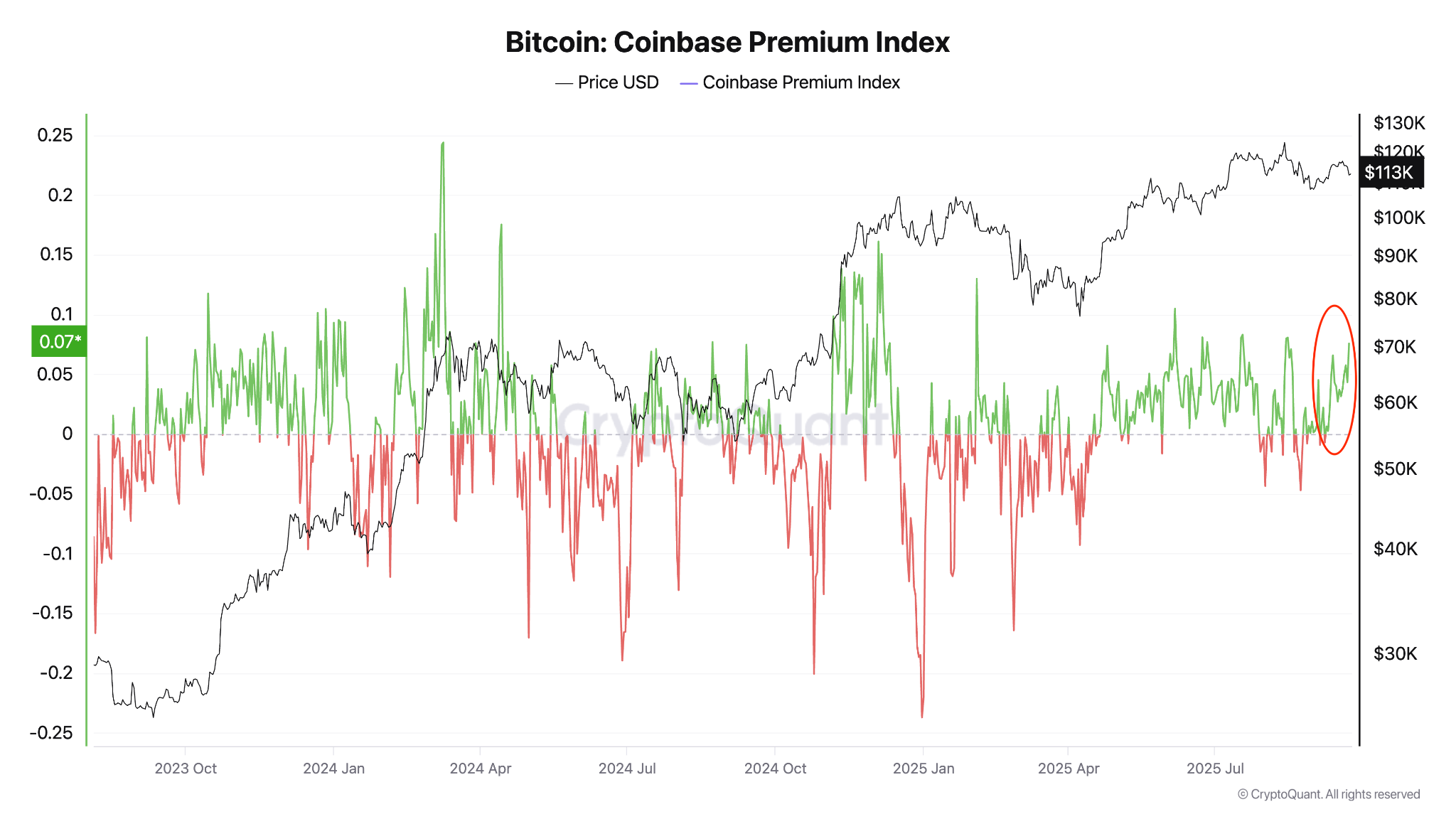

Coinbase Premium stays positive despite price dip

Bitcoin’s recent recovery to a four-week high of $118,000 from a low of $107,400 between Sept. 1 and Sept. 18 could be partially attributed to increased retail demand in the United States. That was evident by a sharp rise in the Coinbase Premium Index over that period.

The Coinbase Premium Index measures the difference in pricing between the BTC/USD pair on the largest US exchange, Coinbase, and Binance’s BTC/USDT equivalent.

Related: Biggest long liquidation of the year: 5 things to know in Bitcoin this week

More importantly, the index remains positive, rising to 0.075 on Sept. 22 from 0.043 on Sept. 21, even as Bitcoin tumbled 4% to $112,000.

“The Coinbase premium stayed positive all week,” even with the latest sell-off, said analyst BTC_Chopsticks in an X post on Monday, adding:

“As long as the index stays positive, I remain bullish on BTC.”

A rising Coinbase premium is a proxy for increasing demand from US retail investors.

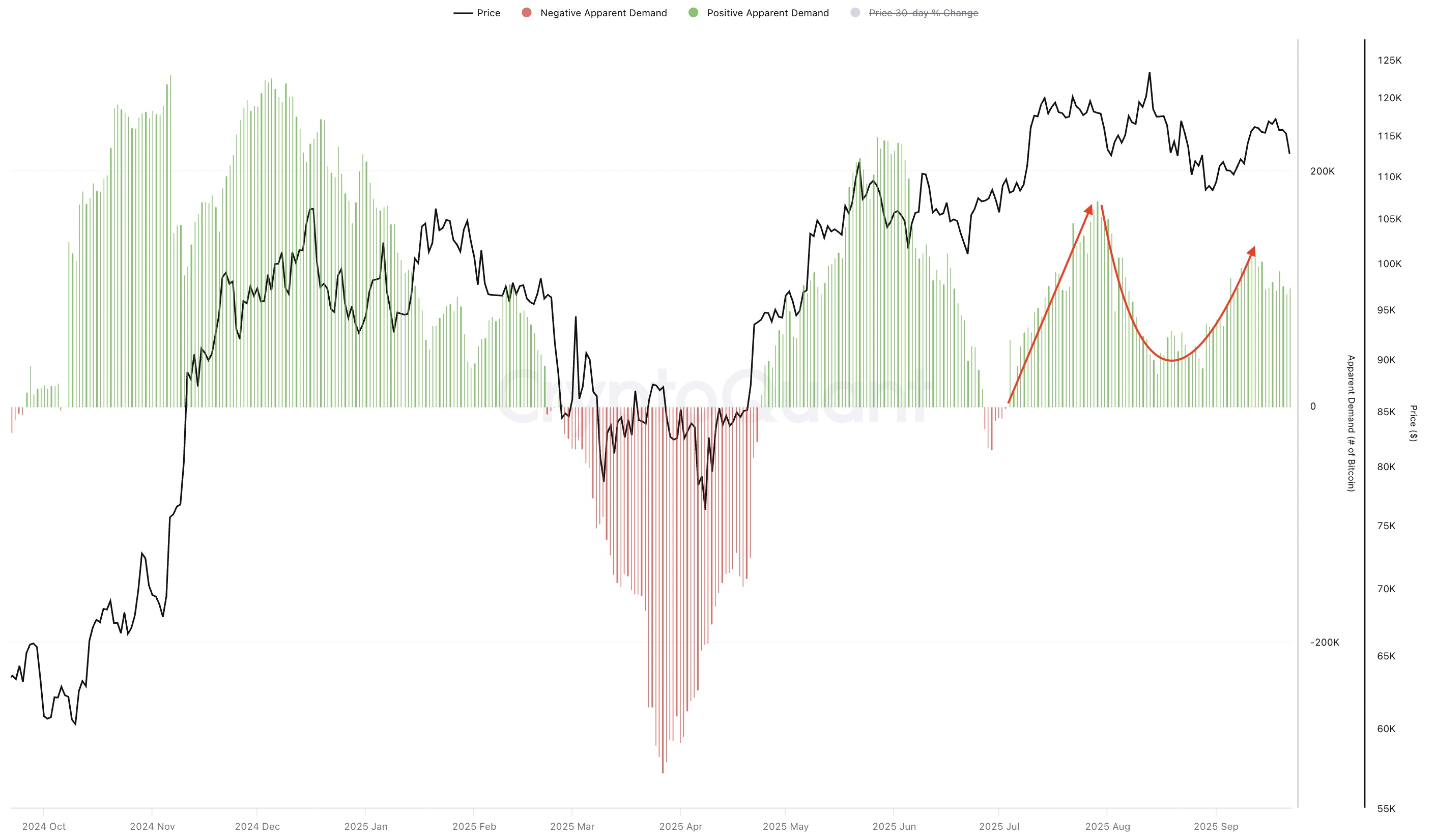

Additionally, Bitcoin’s apparent demand, which offers a broader onchain view of worldwide BTC demand, remains high despite yesterday’s price drop, with a slight increase over the last 24 hours.

This suggests that new investors continue entering the market, providing the tailwinds required to trigger BTC price recovery.

Institutional Bitcoin demand “remains firm”

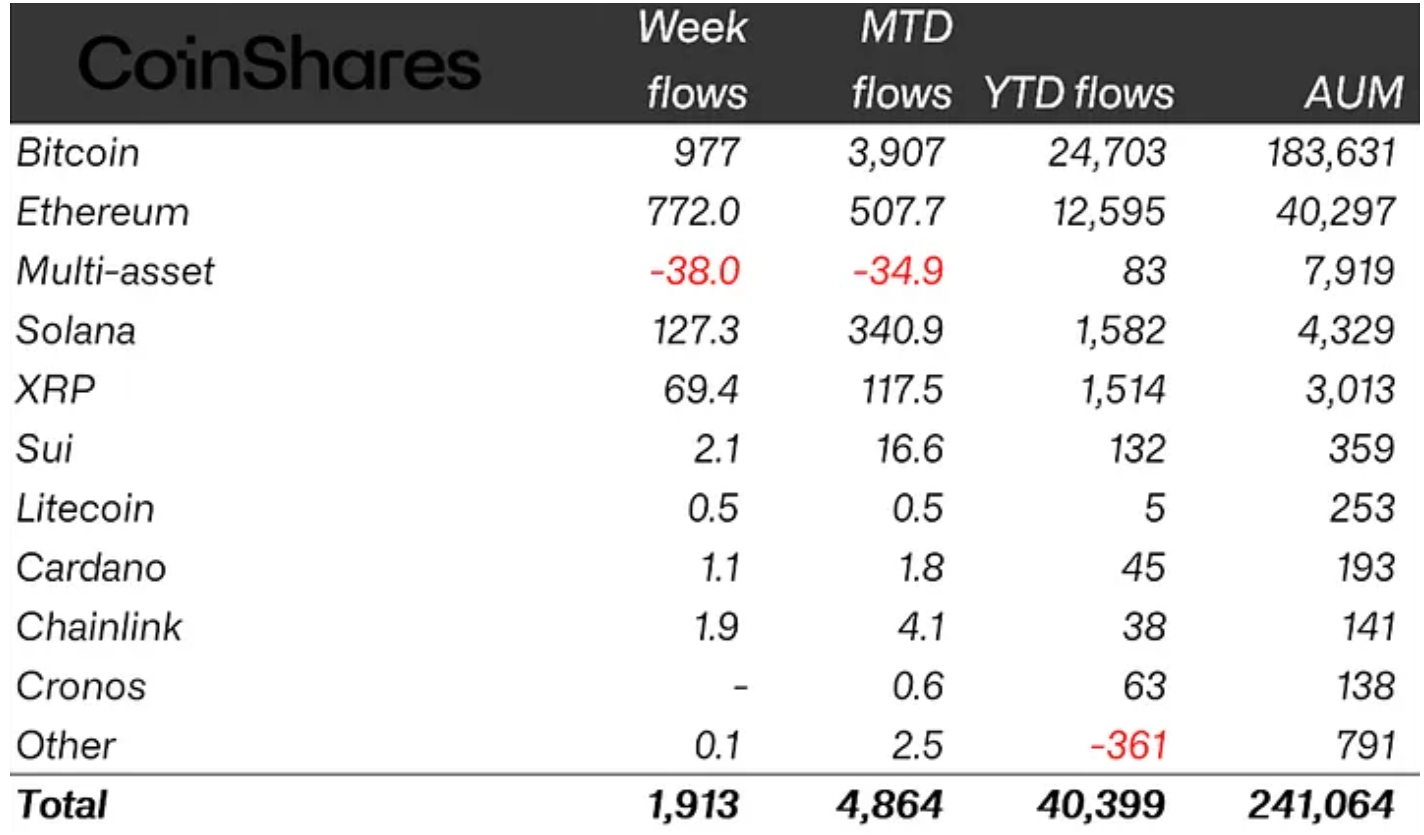

BTC’s upside potential is backed by growing institutional demand, evidenced by strong inflows into Bitcoin investment products.

Data from CoinShares shows that institutional investors increased their exposure to Bitcoin investment products, which saw inflows of $977 million, making up more than 51% of the total inflows last week.

US-based spot Bitcoin ETFs saw $876 million in net inflows last week, data from SoSoValue shows.

Meanwhile, Bitcoin treasury companies are aggressively accumulating, with Japan’s Metaplanet becoming the fifth largest Bitcoin holder after acquiring 5,419 BTC for $632.53 million, bringing its total to 25,555 BTC worth nearly $3 billion.

Michael Saylor’s Strategy added 850 BTC for $99.7 million last week, bringing its total Bitcoin holdings to 639,835 BTC.

“Despite near-term weakness, institutional support remains firm,” trading company QCP Capital wrote in a note to investors on Tuesday, adding:

“Strategy and Metaplanet continue to add, while spot ETF inflows last week signal sustained dip-buying. ”

Traders are also positioning for October, which is “historically BTC’s strongest month, with active demand for 120K–125K Calls,” it added.

BTC absorbs sell-side pressure from short traders

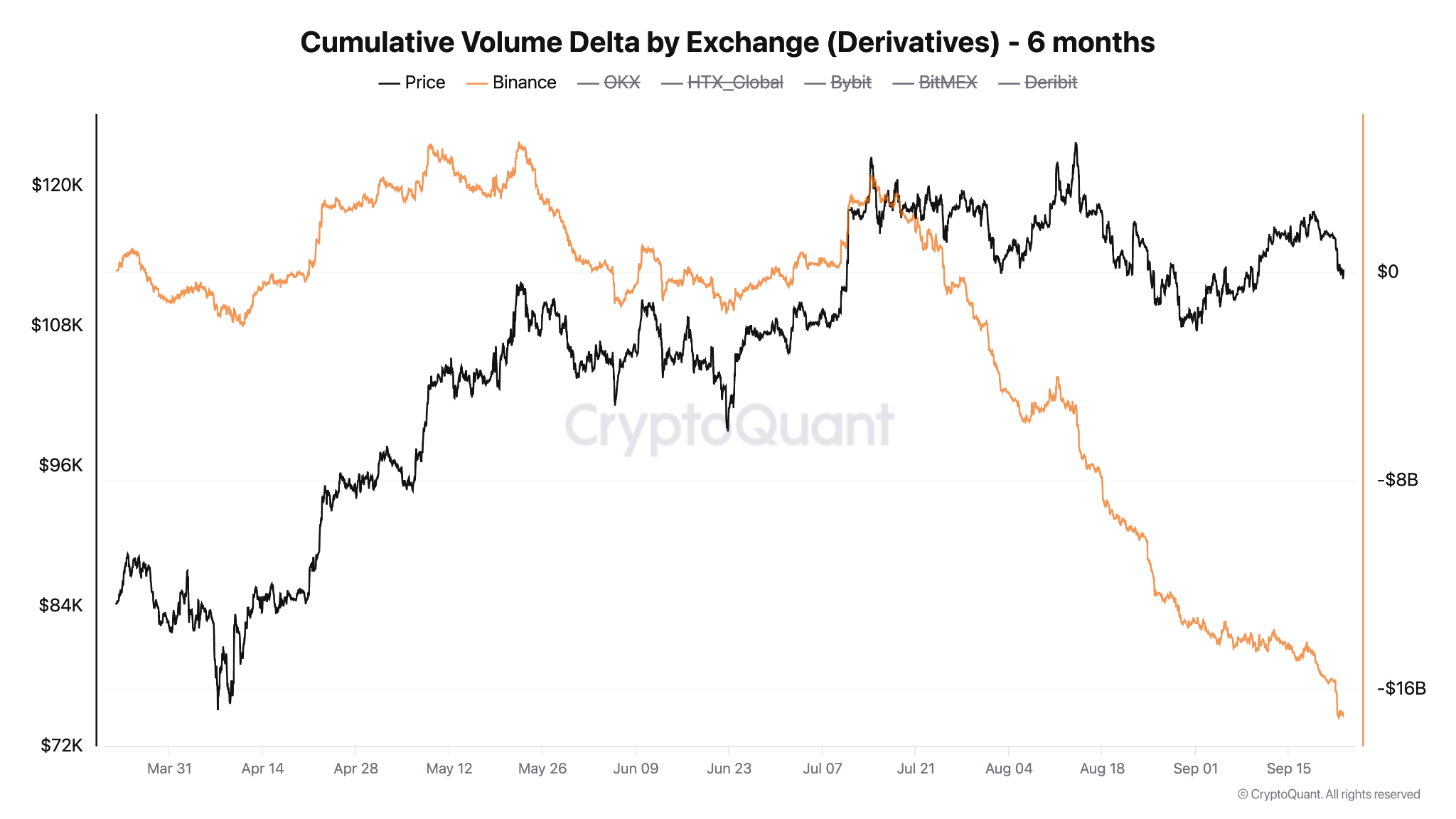

Despite sustained sell-side aggression on Binance derivatives since mid-July, Bitcoin has mostly held its ground within a tight $110,000–$120,000 range. Cumulative Volume Delta (CVD) data remains negative, signaling consistent short-selling pressure from takers.

However, the inability of the price to break significantly lower suggests that this flow is being absorbed, implying accumulation.

This structural resilience may be reinforced by liquidation data pointing toward reduced downward pressure.

Bitcoin researcher Axel Adler Jr said that although the massive long liquidations seen yesterday suggested that the bears are dominating the market, the frequency of liquidations remains low, adding:

“Risk of further bearish pressure from liquidations is medium.”

Risk of further bearish pressure from liquidations is medium.

Net Liquidations remain negative near −40M, reflecting ongoing long wipeouts and keeping downside pressure in place. Yet the Liquidation Intensity Z-Score (365d) is neutral/moderate, suggesting no cascade risk for… pic.twitter.com/FRu9spsyCZ

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 23, 2025

High US retail demand, strong institutional support and reduced risk of a liquidation-driven drop strengthen the argument that Bitcoin is forming a bottom near $112,000.

While short-term volatility may persist, the underlying bid, possibly institutional, could make a sharp correction below this level increasingly unlikely.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.