New incentive layer boosts miner economics after Bitcoin halving

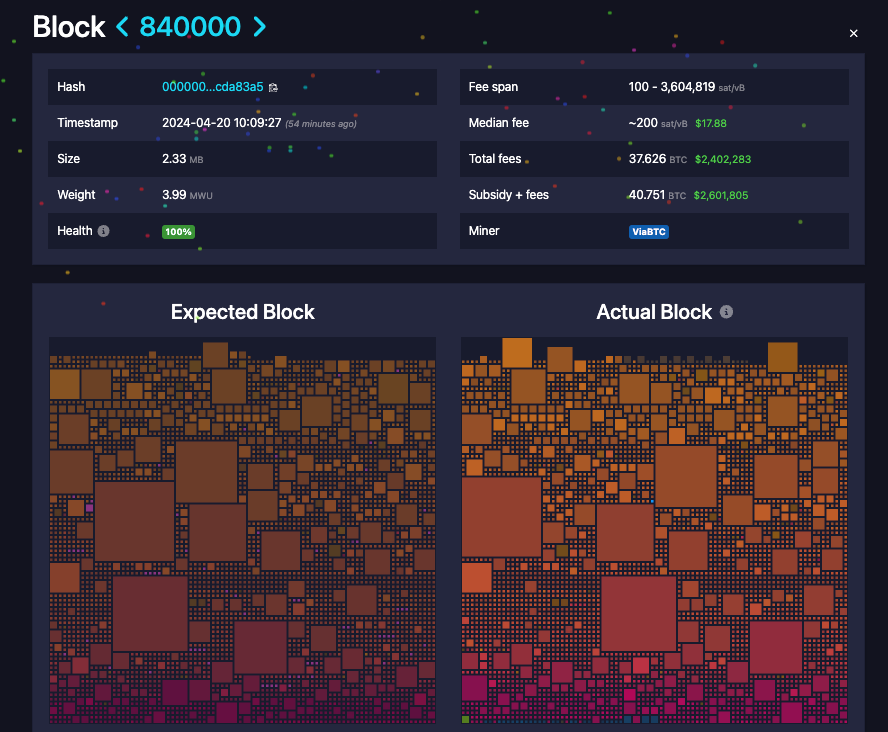

Bitcoin’s fourth halving landed in April 2024 at block 840,000, and it cut issuance to 3.125 BTC per block — a routine event for Bitcoin, yet a profound one for miners’ revenue models. Transaction fees briefly surged around the event, with the halving block paying out more than $2.6 million to the winning miner, which highlighted how volatile fee markets can become as protocol rewards decline.

Analysts have long warned that halving cycles squeeze margins. Research houses describe “hashprice” — revenue per unit of hashpower — trending lower as difficulty adjusts and competition rises. That pattern pressures operators to seek new efficiency or new revenue because the subsidy now pays half as many BTC per block as it did before April 2024.

The network itself keeps growing more capable and more creative. Ordinals activity and new onchain protocols have lifted fee intensity in waves, and Runes-driven minting during the 2024 halving window offered a preview of how “user demand for blockspace” can supplement the base subsidy. Fees reached record levels around that period, which signaled a structural path for miners to earn more when activity heats up.

At the same time, the mining landscape concentrates around large pools that aggregate hashpower. Industry trackers regularly show Foundry USA and Antpool among the largest pools by share, which highlights the scale at which professional operators now compete for thinner per-block rewards. This is the backdrop for incentive design that aims to keep miners engaged and Bitcoin secure.

A Bitcoin-native route to programmable assets

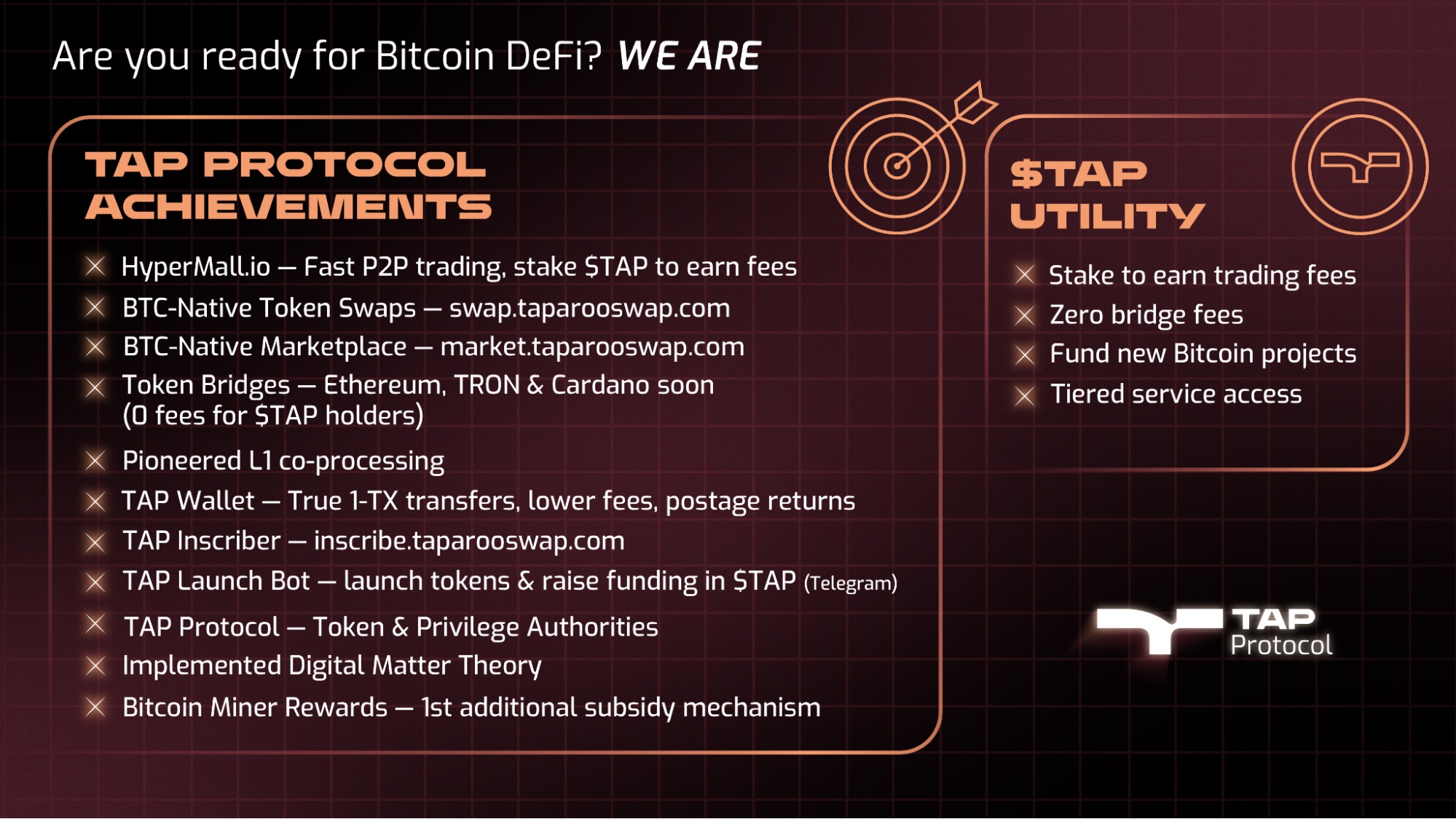

One answer arrives from a Bitcoin-first programmability layer that lives on Bitcoin itself. TAP Protocol builds directly on top of Ordinals and enables native Bitcoin smart contracts — no L2s, rollups or sidechains — and it uses a model the team calls “L1 co-processing.”

In practice, developers can leverage smart contracts on other L1s to co-process logic while all transactions still settle on Bitcoin, which preserves self-custody and Bitcoin’s security guarantees.

TAP’s approach already powers live DeFi primitives. In October 2024, the team introduced TaparooSwap as an automated market maker (AMM) on Bitcoin layer 1, which brought peer-to-peer swaps and liquidity pools to mainnet settlement. For builders, that means Ethereum-style expressiveness with Bitcoin finality.

A second subsidy that pays miners on every block

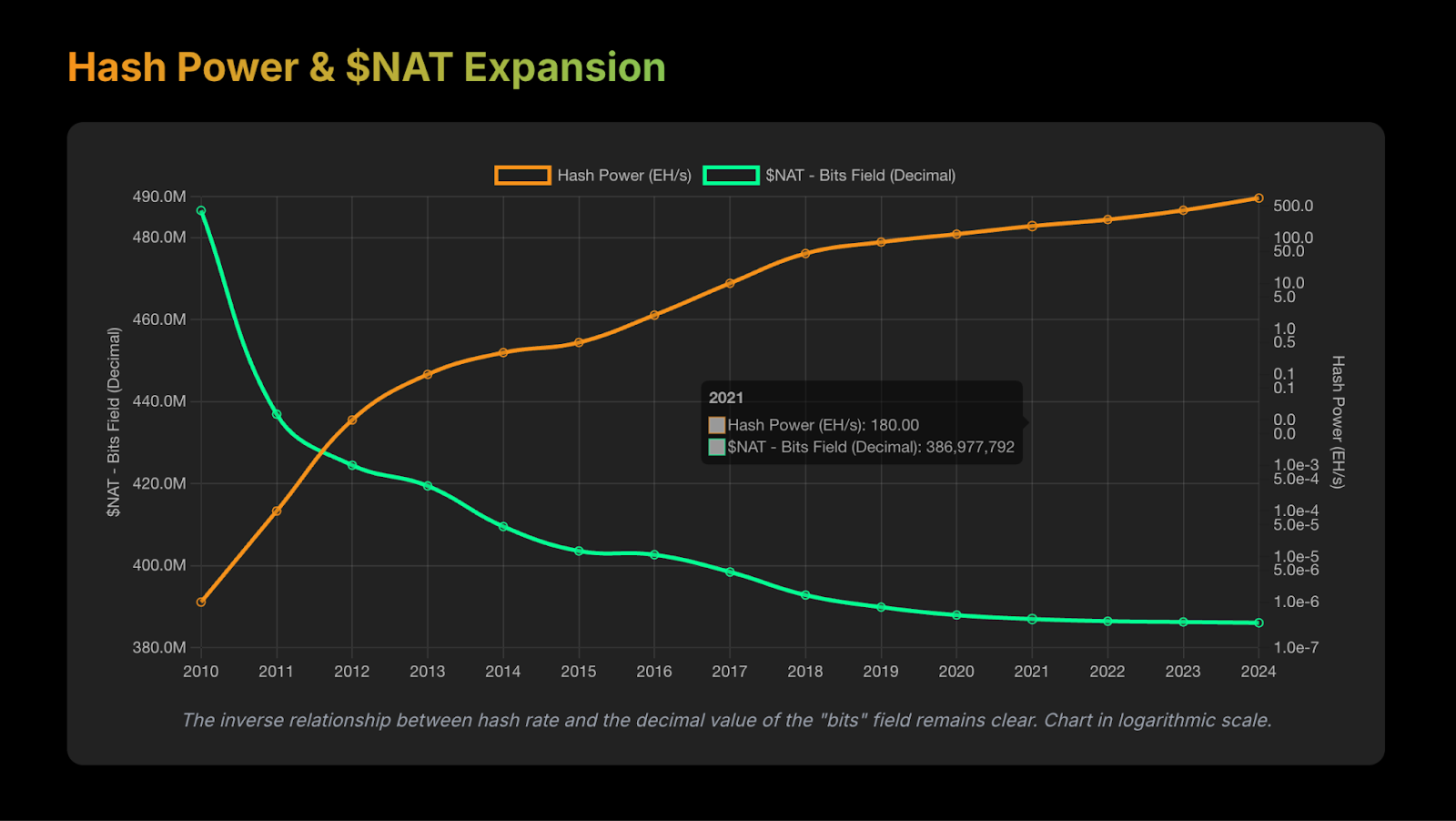

The most striking TAP-enabled use case for post-halving incentives is NAT, a token aligned with Digital Matter Theory (DMT) that uses Bitcoin’s own block data to determine issuance. Starting at block 885,588 on Feb. 27, 2025, every winning Bitcoin block began to trigger a NAT distribution into the miner’s wallet in addition to the BTC they earned. The amount adjusts with network conditions because it derives from Bitcoin data at the moment of confirmation, based on block difficulty.

DMT describes assets that emerge from patterns in onchain data rather than arbitrary mints. NAT applies that framework so production becomes programmatic and Bitcoin-controlled, and the distribution goes directly to block winners. Advocates see this as a way to align a secondary incentive with the base chain’s security budget — the miner does ordinary Bitcoin work and also receives a NAT payout that maps to Bitcoin’s state.

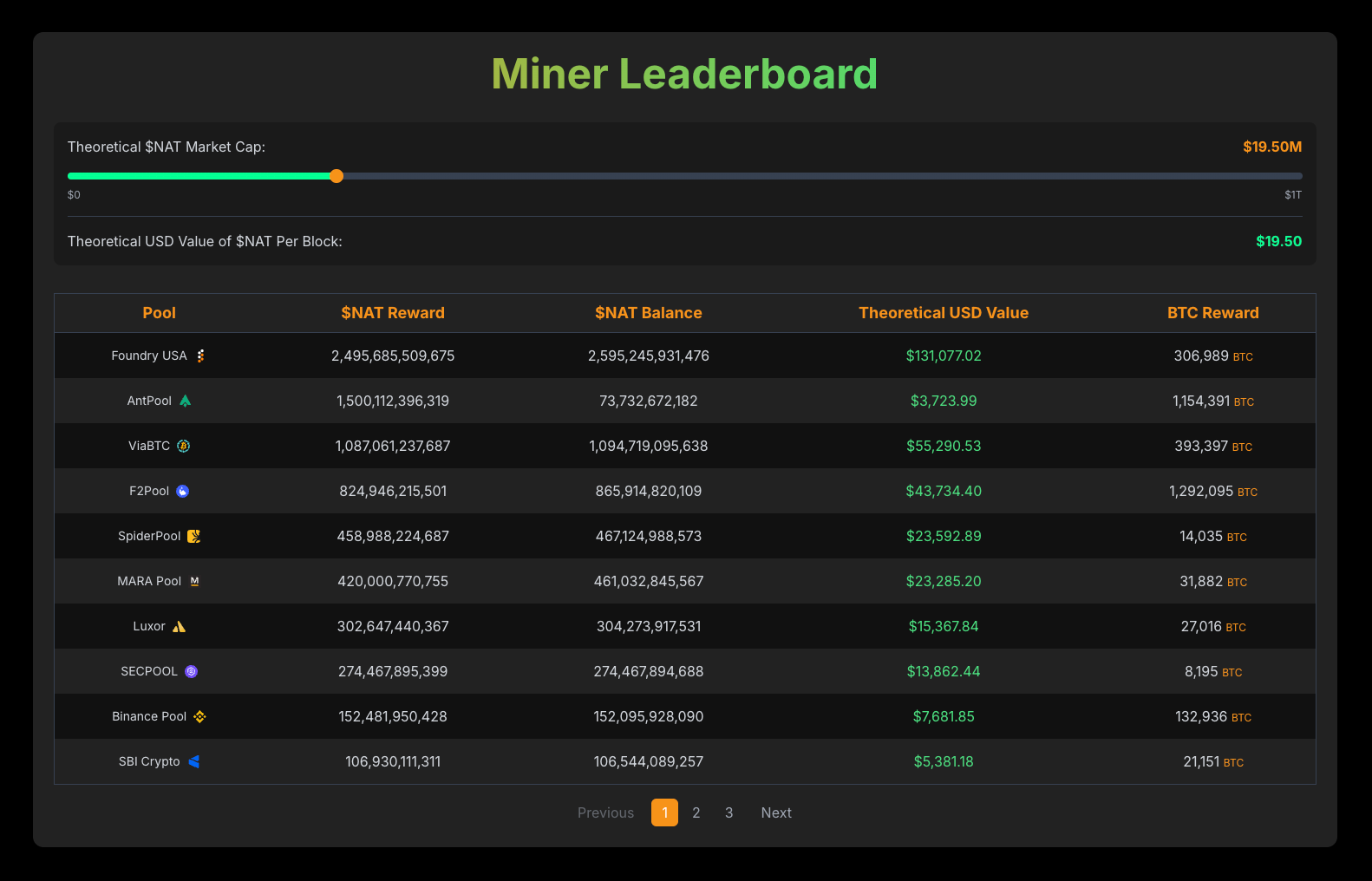

Early signals from major pools

Community attention has focused on whether large pools recognize or claim their accrued NAT. Commentators tracking mining wallets highlighted Spiderpool activity and communications that referenced NAT rewards alongside BTC, which suggested operational uptake by one of the bigger pools. Those observations fueled expectations that more pools could turn on the mechanism as it matures.

TAP contributors and ecosystem voices have also chronicled the milestone activation at block 885,588 and ongoing miner interactions with the token. While onchain sleuths and third-party channels continue to analyze flows, the core idea has entered miner discourse — a secondary, Bitcoin-aligned payout that arrives with the same block that secures the network.

From wallets to real-time apps — without leaving self-custody

Incentives only matter if assets move where users are. Through TAP’s “Token Authority” primitive, users can grant permissioned access to TAP assets and keep self-custody while interacting with Trac Network — a blockless, local-first L1 for real-time decentralized applications (DApps). That design gives 1-second finality for in-app activity while ownership remains anchored to Bitcoin layer 1, and users can withdraw back to their wallet whenever they choose.

https://www.youtube.com/watch?v=46saZxONdcM

This model broadens NAT’s surface area. Miners can receive the asset at coinbase-adjacent events — simultaneously with the block-creating transaction —, traders can find liquidity on Bitcoin-settled venues like TaparooSwap and consumer apps can tap TAP-authorized balances through Trac-powered interfaces. The loop drives activity toward mainnet settlement and keeps keys in users’ hands.

Toward App3 — self-sovereign apps on Bitcoin

TAP and Trac outline a future where software runs locally and peer-to-peer. Users hold assets and execute logic under their own control with no reliance on third-party wallets or hosted backends.

Trac Network provides a blockless, real-time base for decentralized apps with built-in nodes, smart contracts and wallets. TAP anchors asset ownership to Bitcoin layer 1 in every scenario, so teams can pursue fast user experiences while they maintain settlement on the chain with the deepest security budget.

Together they form “App3” — a class of self-sovereign applications where computation, identity and value live on the user’s device. The stack removes external dependencies such as cloud services, third-party data providers and APIs, including centralized oracles for crosschain interoperability.

This vision sets clear roles for each participant. Builders ship responsive apps without surrendering custody. Users transact with finality and keep their keys. Miners secure the base layer that records every outcome. As App3 gains traction, Bitcoin evolves into the universal settlement and trust anchor for a more private, resilient internet of value.

Find out more about TAP Protocol and Trac Network

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.