Bitcoin’s insider story — George Kikvadze on building its backbone

Bitcoin (BTC) was born as a defiant response to the failures of centralized finance during the 2008 global crisis. As banks crumbled and governments printed trillions, a new idea emerged — money secured by code, not politics; a network with no rulers, borders, or bailouts.

George Kikvadze grew up watching the opposite world. In Soviet Georgia, his parents — both doctors — lost their life savings overnight when the ruble collapsed, followed by hyperinflation that erased what little remained. That experience turned him into a lifelong skeptic of centralized power and fragile fiat systems.

When he discovered Bitcoin in 2013, it wasn’t just an investment — it was a revelation. The idea of mathematically guaranteed scarcity and independence resonated deeply. Soon after, Kikvadze joined Bitfury, helping transform it from a bold startup into one of the key industrial architects of Bitcoin’s infrastructure — with later spinouts including Cipher Mining (CIFR), Hut 8 (HUT), and LiquidStack.

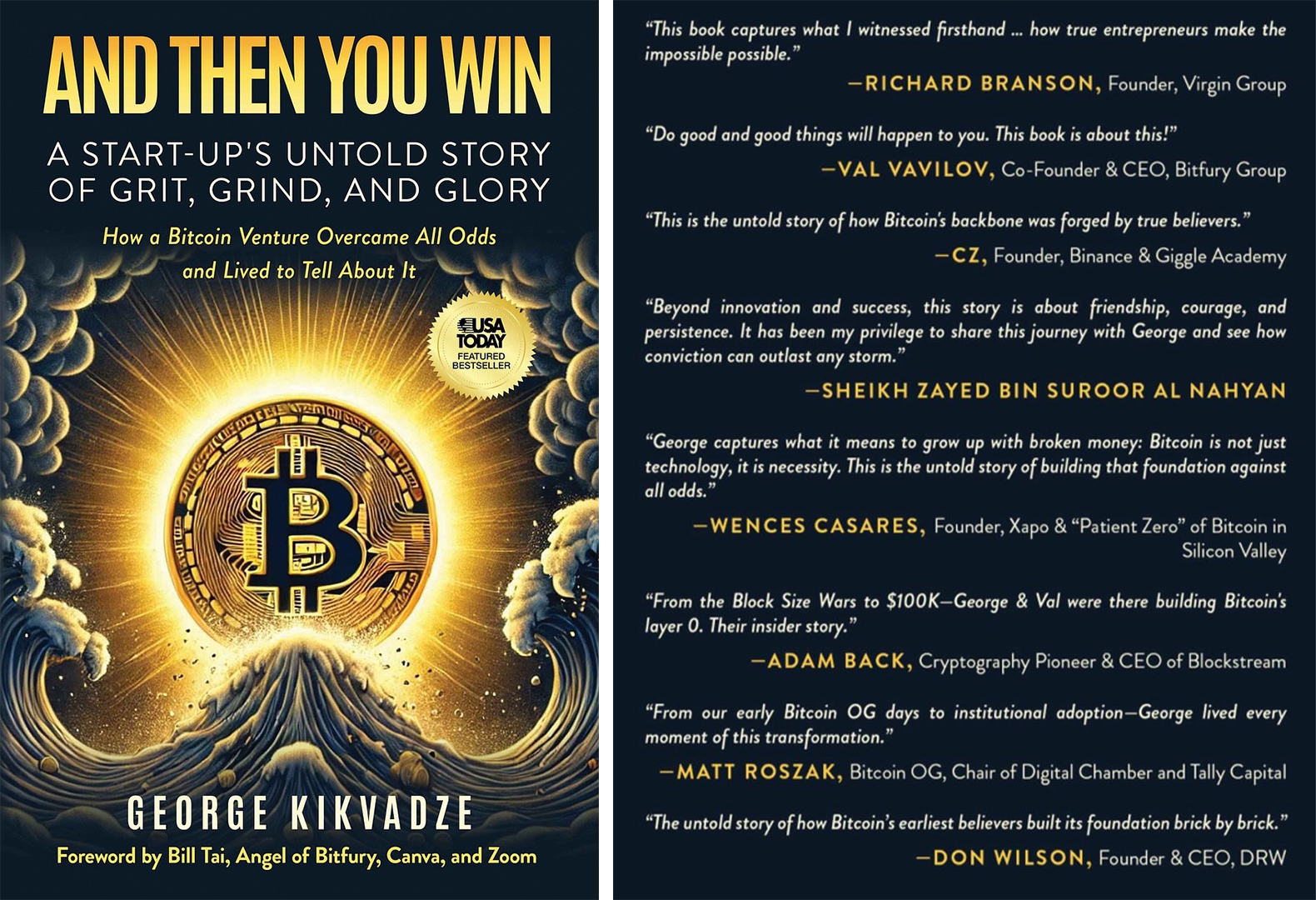

Kikvadze’s conviction now culminates in his book, And Then You Win, set for release on Satoshi Day (Oct. 31). The book captures Bitcoin’s journey through the lens of someone who helped build its backbone — an insider account of the grit, risk, and vision that carried it from ridicule to recognition.

In this conversation with Cointelegraph, Kikvadze reflects on early lessons, building through volatility, and why the next great “win” for technology will be the convergence of blockchain and AI.

Cointelegraph: What early experience most clearly shaped the lens through which you first understood Bitcoin’s potential?

George Kikvadze: Growing up in Soviet Georgia, I watched my parents lose everything when the system around them imploded. That kind of collapse leaves a permanent mark. You realize how fragile money can be when it depends on trust in institutions rather than rules in code.

Years later, Bitcoin clicked instantly. It was the perfect alignment of math, logic, and trustlessness — a system that couldn’t be manipulated or inflated. My love of mathematics met my distrust of central control, and from that moment, I knew this was the foundation of a new financial world.

CT: What scene in “And Then You Win” best captures the moment Bitcoin shifted from being laughed at to being taken seriously?

GK: There were two defining moments.

First, when Paul Tudor Jones publicly compared Bitcoin to gold and called it a hedge against inflation, that was the day Wall Street started paying attention.

THAT’S A WRAP. #AndThenYouWin drops October 31st—Satoshi Day. Massive gratitude to @KiteVC for his foreword and @richardbranson @ValVavilov @cz_binance @adam3us @MatthewRoszak Wences Casares and Don Wilson for endorsements. Yes, we incubated $CIFR & $HUT (approaching $5B each),… pic.twitter.com/jR0ulx22bN

— George Kikvadze (@BitfuryGeorge) September 18, 2025

The second was when Larry Fink and BlackRock launching the first Bitcoin ETF. When the world’s largest asset manager validated Bitcoin, the laughter stopped. Those moments marked Bitcoin’s graduation — from an outsider’s rebellion to a strategic allocation in global portfolios.

CT: Why did you choose to build infrastructure rather than trade the asset, and how did that conviction sustain you?

GK: Because infrastructure shapes the long game. Anyone can trade volatility, but the real impact comes from building the rails that make an ecosystem possible.

At Bitfury, we were designing ASIC chips, building data centers, and securing the network’s core. It wasn’t glamorous — it was foundational. Trading can make you money; building can change history. Conviction came from knowing that every megawatt we deployed was another brick in Bitcoin’s fortress of trust.

CT: How did you balance candor with confidentiality when recounting the boardrooms, late-night calls and public battles in the book?

GK: And Then You Win isn’t a press release — it’s the first genuine insider story of Bitcoin’s rise. For years, every public statement went through legal filters. That’s not how history should be told. Today, Bitfury has evolved into a global innovation and investment platform, giving me the freedom to tell the story authentically — with all the pressure, mistakes, and human drama that came with it.

CT: What principle guided your decision to spin out companies like Cipher Mining, Hut 8, and LiquidStack?

GK: Each spin-out was guided by timing and opportunity. Hut 8 began as Bitfury Canada, and Timing and focus.

Hut 8 started as Bitfury Canada. When Canadian capital markets opened to Bitcoin miners in 2017, we spun it out — letting local investors participate in the story.

Cipher Mining was Bitfury USA. When the SPAC boom hit, we saw the chance to unlock value through U.S. markets while expanding our Texas energy footprint.

LiquidStack was different — it was born from our belief that high-density cooling would underpin both AI and HPC. We brought in Joe Capes from Schneider Electric to lead it, and that bet is now paying off.

Each move had one guiding principle: empower the right team to scale at the right moment in the right market.

But hey, it’s all in the book with a lot of color. I am sure readers will enjoy it.

CT: Which one of your book’s “21 principles” matters most for founders building in volatile, regulated markets today?

GK: “Never give up — adapt relentlessly.”

Volatility is a feature, not a bug, in frontier industries. Timing waves in innovation is everything, and most people give up just before the tide turns. As my friend Bill Tai says, the key is to stay patient, stay ready, and know when to paddle hard.

At Bitfury, we built through bear markets when everyone else disappeared. I always tell founders: if you hang around the barbershop long enough, sooner or later you’re going to get a haircut. Persistence beats timing.

CT: If readers adopt only one practice for leading through chaos from this book’s blueprint, what do you want it to be?

GK: Listen more than you talk.

In chaotic times, the loudest voices often make the worst decisions. The best leaders — whether in startups or global organizations — are the ones who listen deeply: to teams, markets, and even their critics.

As Wayne Gretzky said, “Skate to where the puck is going, not where it’s been.” Listening is how you sense that direction before anyone else. Leadership through chaos isn’t about speed; it’s about awareness, humility, and decisive courage.

CT: In the spirit of “And Then You Win,” what does the next “win” look like for the blockchain and crypto space — and what would signal it’s truly arrived?

GK: The next big win will come from the convergence of blockchain and AI.

We’re entering an era where decentralized compute, storage, and data integrity will become the foundation for intelligent systems. Bitcoin decentralized trust. AI will decentralize intelligence. And blockchain will provide the rails connecting those freedoms.

When value, data, and computation flow seamlessly without intermediaries, we’ll enter the next era of what I call “Freedom Tech.” That’s the next great story worth telling — and living.

Find out more about George Kikvadze and his book And Then You Win

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.