Bitcoin Falls To $109K After Fed 0.25% Rate Cut: Why?

Key points:

-

Bitcoin’s sell-off accelerated after the Federal Reserve cut rates by 25 basis points.

-

Weakness in crypto shows traders are looking at macroeconomic headwinds like a weakening jobs market and inflation, despite believing that interest rate cuts will continue into 2026.

Bitcoin (BTC) price tumbled to $109,200 ahead of Wednesday’s US Federal Reserve decision to cut interest rates by 25 basis points. While traders may have anticipated a degree of risking-off ahead of Fed Chair Jerome Powell’s announcement, BTC’s 6% drop from its Monday rally to $116,400 is sharper than anticipated, especially considering that the consensus among analysts is a 25 basis point rate cut.

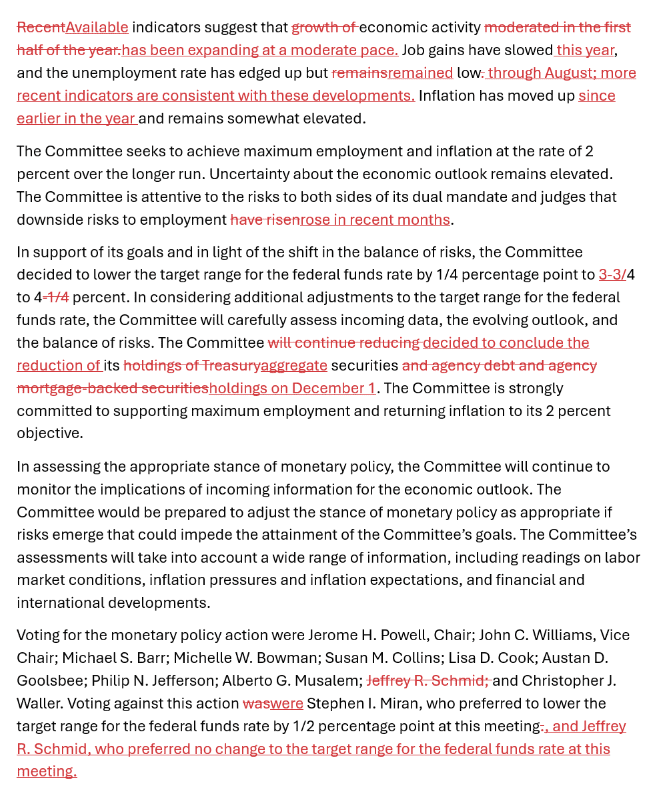

The Fed’s dot plot currently shows a baseline of three cuts in 2025. Analysts at Goldman Sachs are already predicting at least two more 25 basis point cuts by March and June of 2026, which would place the Fed’s benchmark in the 3% to 3.25% range, so with that view in mind, Bitcoin’s near-term price action is counter to traders’ expectations.

Analysts at Hyblock, a crypto analytics company, said:

“Recent history has shown that the FOMC leads to a price drop in BTC, followed by a move up. This was the case in both the no rate change and rate cut (last one) scenarios. If price does dip post-FOMC and signs of bullish confluence emerge, such as bid-heavy orderbooks, it would likely present good opportunities for investors.”

Given that the market consensus leans toward rate cuts for the foreseeable future, investors’ focus has shifted to a “what comes next, beyond the cuts” point of view. The growing US job layoffs, the longer-term impact of President Trump’s tariff war, and whether or not the artificial intelligence sector is in a speculation-fueled bubble or an industry sitting on sound fundamentals.

These are all topics traders will be looking out for during Powell’s FOMC presser on Wednesday, and they are likely to impact Bitcoin’s price action more than today’s interest rate cut, which was essentially priced in, given the 100% consensus that a 0.25% cut was on the way.

A notable addition to the FOMC statement was confirmation that the Fed will cease shrinking its balance sheet on Dec. 1, marking an end to quantitative tightening.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.