Bitcoin Drops To $107K As Big Tech Stocks Flop On AI Concerns

Key points:

-

Bitcoin charts suggest a downside to $103,800 and a final flush below $100,000 as the most likely outcome in the short term.

-

Investor concerns about Big Tech companies’ CAPEX costs for their AI infrastructure reflect a speculation-driven market.

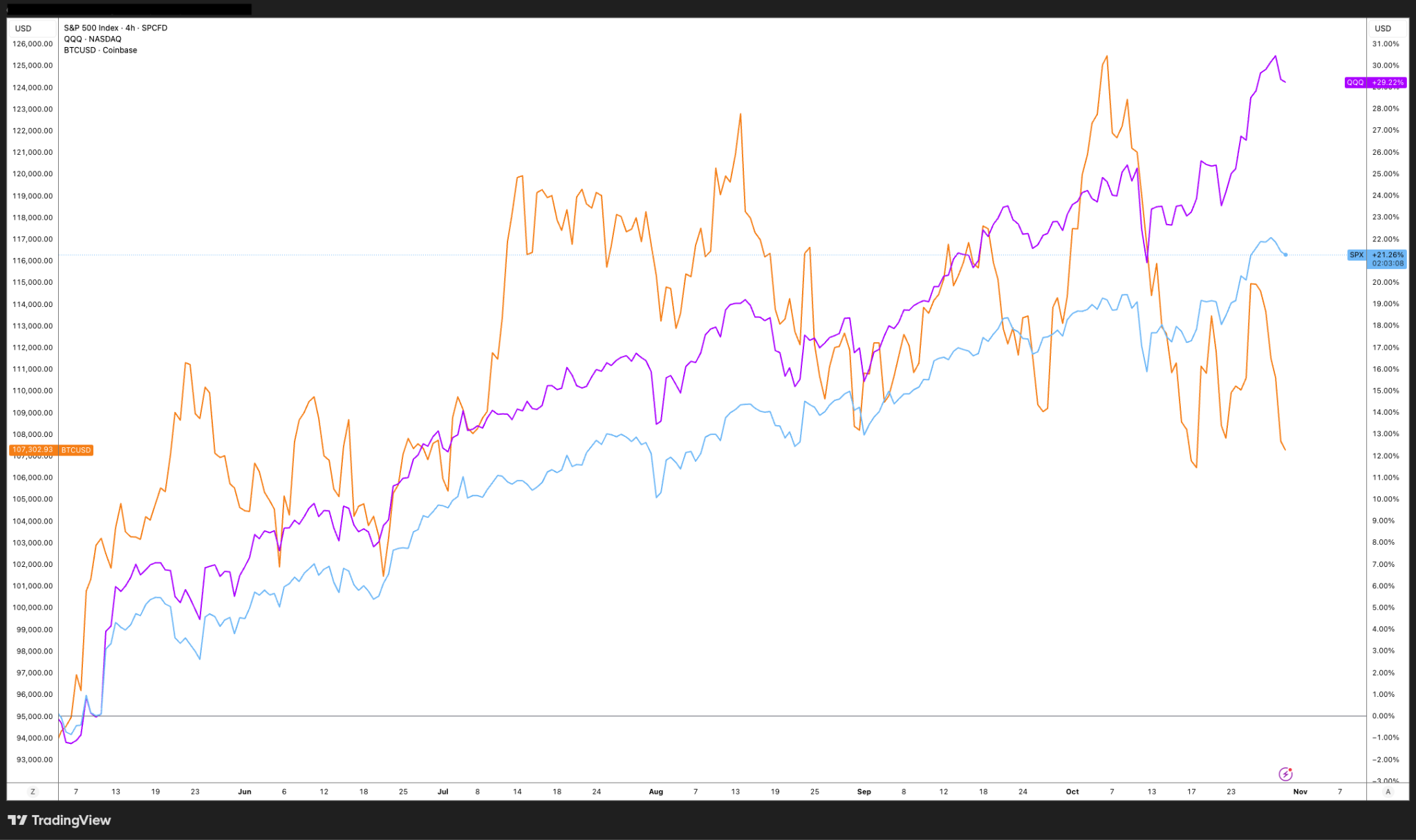

Bitcoin’s (BTC) end-of-month sell-off accelerated as the price dropped to $107,328 shortly after the NY open and was followed by an intraday low at $106,800. The move mirrors a slight weakness in US stock markets, where the S&P 500 and Nasdaq show slight losses despite third-quarter Big Tech earnings being forecast to surpass expectations.

Magnificent Seven giants Meta and Microsoft saw respective 10% and 3% drops in their share prices as investors’ skepticism at Big Tech companies’ spending on AI investment overshadowed positive earnings reports. Meta boosted its capital expenditure on AI to the $70 billion–$72 billion range, while Alphabet has forecast up to $93 billion in CAPEX dedicated to the AI buildout.

The market also appears not to be buying into President Trump’s positive description of his trade deal meeting with Chinese President Xi Jinping. Beyond a cut to the fentanyl-related tariffs and China agreeing to delay its ban on rare earth exports by one year, few details regarding the nature of the discussion and any ensuing deal have emerged, thus leaving the US-China trade war as an overhanging risk event for investors.

Related: Bitcoin risks ‘20-30%’ drop as crypto markets liquidate $1.1B in 24 hours.

Bitcoin’s lackluster price performance is surely an unexpected outcome for investors who forecast a rally to range highs if a Trump-China trade deal, Federal Reserve 25 basis point cut to interest rates and the end of the quantitative tightening policy were all confirmed by the end of October.

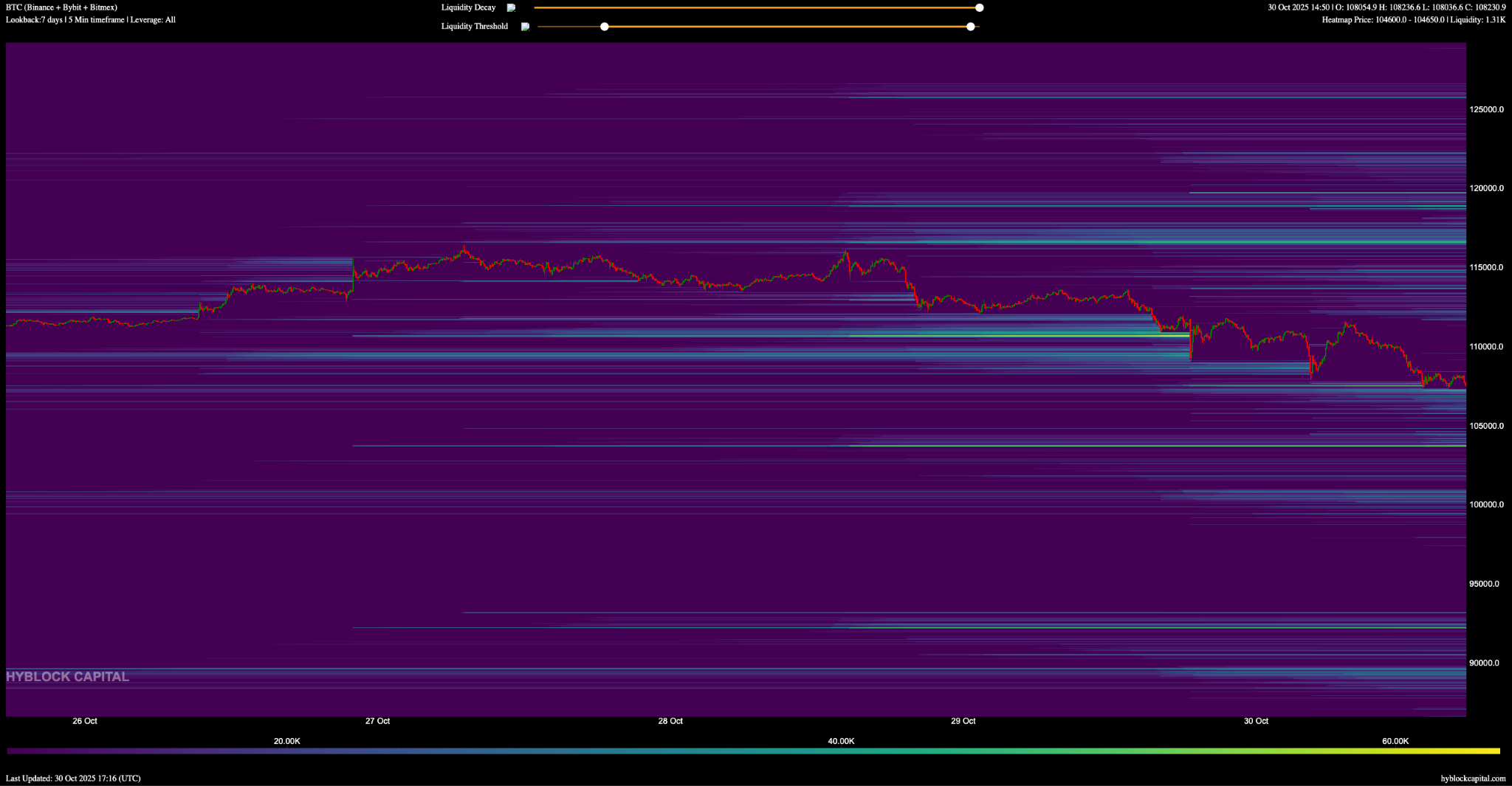

As things currently stand, the path of least resistance for Bitcoin remains to the downside, with Hyblock’s liquidation heatmap data showing the most immediate liquidity at $103,800.

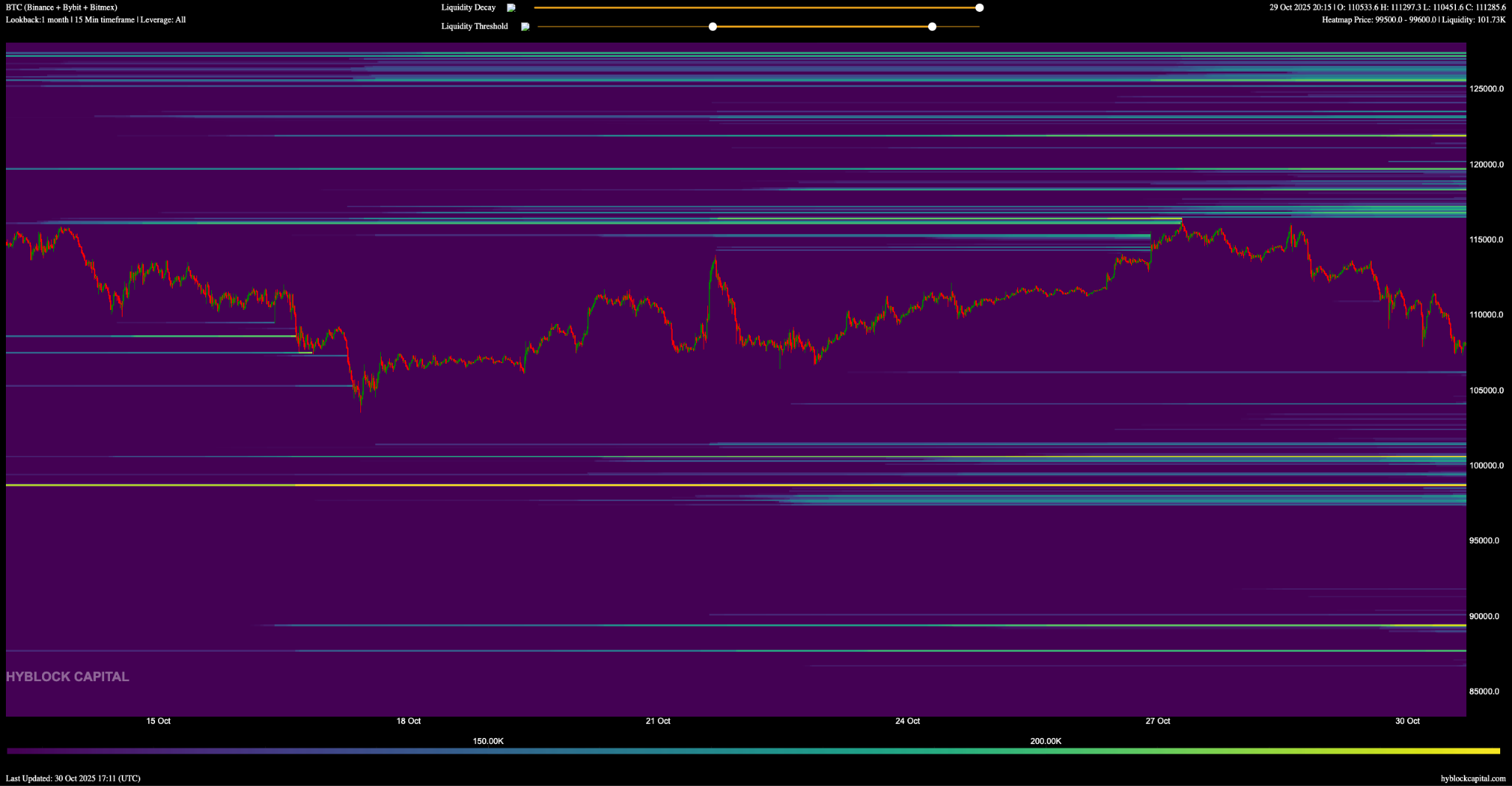

The 1-month lookback, which includes longer-held positions, shows long liquidity at $100,500 and $98,600.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.