Crypto Lags Gold and Stocks, but 2026 May Spark Catch-Up Rally

The crypto market will be bleeding into 2026 depsite other major assets gaining; however, there will be a chance for crypto to play catch-up in the new year, according to market intelligence platform Santiment.

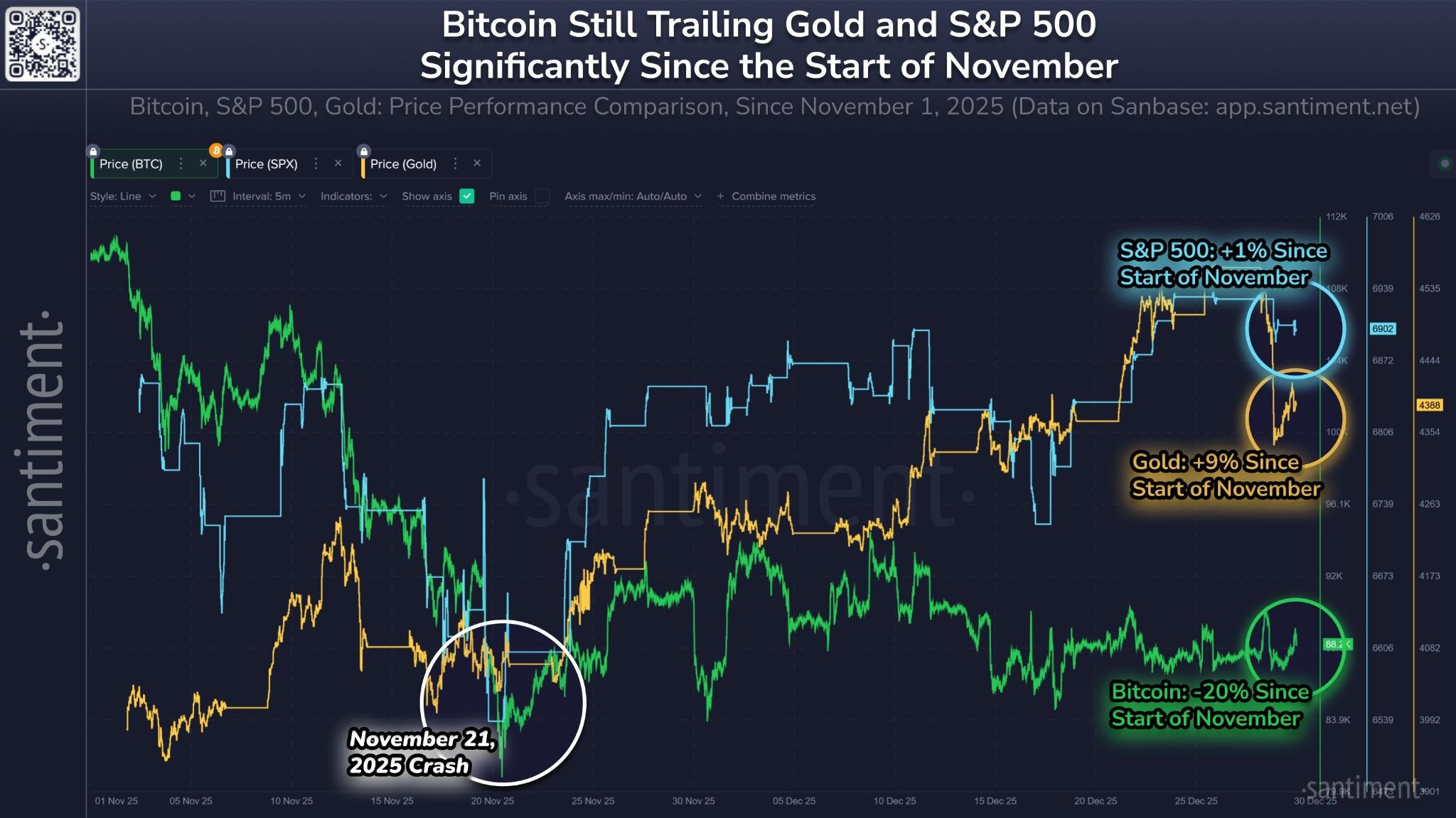

In an X post on Tuesday, analysts from Santiment said Bitcoin (BTC) is trailing behind gold and the stock market index S&P 500, which have both made slight recoveries after a crash in November saw bleeding across the board.

Since the start of November, gold is up 9%, the S&P 500 is up 1%, and Bitcoin is down 20%, trading for around $88,000 as of Wednesday.

“The correlation between Bitcoin & crypto compared to other major sectors is still lagging behind,” Santiment analysts said, adding that “Heading to 2026, there will remain an opportunity for crypto to play catch-up.”

Whales waiting on the sidelines

Large holders scooping up crypto again could be the first sign of a shift back, as whales slowed accumulation in the second half of 2025, according to Santiment.

“The second half of 2025 was dominated by aggressive accumulation by the small wallets, while large wallets essentially stayed flat, rising up to the Oct ATH, then selling.”

Generally, large holders and whales are considered market movers, and their trades can influence market behavior, liquidity, and investor psychology.

“Historically, the best recipe for a bear pattern to flip to a bullish one is when large wallets accumulate, and retail dumps,” Santiment analysts added.

Long-term Bitcoin holders have also stopped selling, pumping the brakes on offloading crypto for the first time six months after trimming their positions from 14.8 million coins in mid-July to 14.3 million in December.

Shift back into crypto could already be underway

Garrett Jin, former CEO of the now-defunct crypto exchange BitForex, speculated that traders have already started to shift out of other sectors and back into crypto.

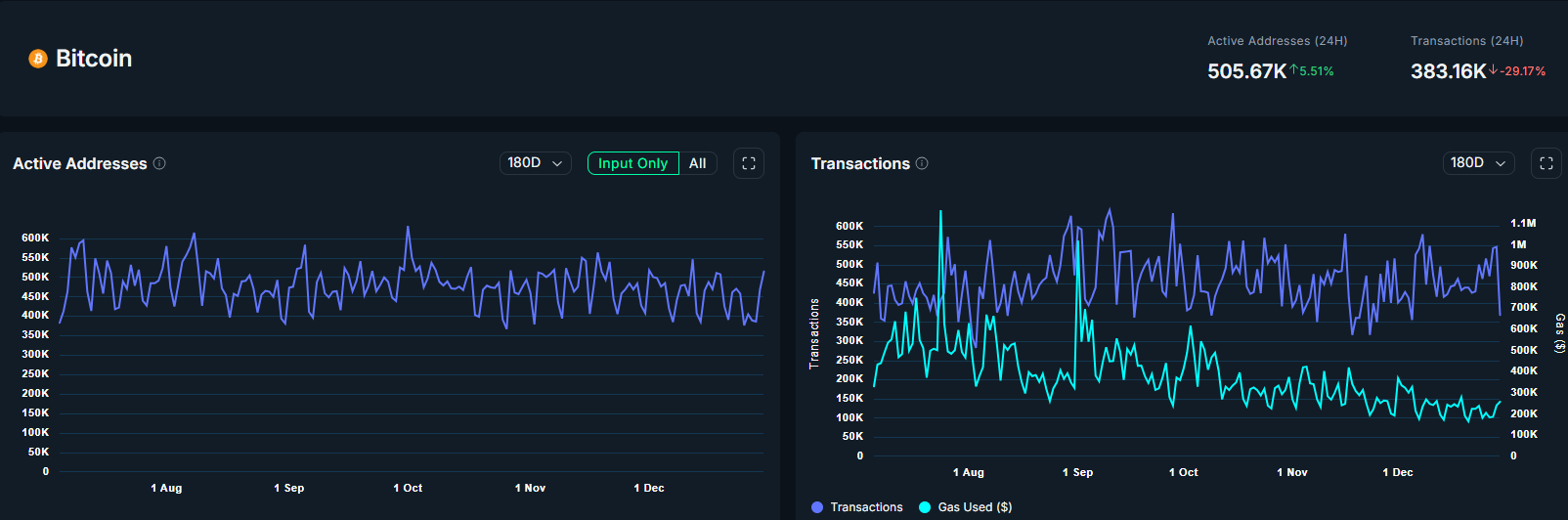

Data from the on-chain analytics platform Nansen shows that the number of active Bitcoin addresses has risen 5.51% in the last 24 hours, while transactions are down nearly 30%.

“The short squeeze in metals is over as expected. Capital is beginning to flow into crypto,” Jin said on Tuesday, adding in response to a user’s question about whether traders investing in precious metals also buy crypto, “Capital is the same. Always sell high and buy low.”

Related: Bitcoin’s $90K rejection: Is BTC’s digital gold narrative losing to bonds?

At the same time, investor and market analyst X account CyrilXBT, said the market is in a “classic late-cycle positioning before a shift.”

“When liquidity turns and BTC breaks structure: Gold cools, BTC leads, ETH follows, Alts finally wake up. The market always moves before the narrative does. Stay patient. This phase is designed to test conviction.”

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?