CME to launch Solana and XRP options as US derivatives grow

The Chicago Mercantile Exchange Group (CME), the world’s largest derivatives exchange, will expand its crypto offerings by introducing options on Solana and XRP futures starting Oct. 13.

The move builds on record trading activity in Solana (SOL) and XRP (XRP) futures contracts since their launches earlier this year, according to the exchange. It also marks the first time CME has extended its options offering beyond Bitcoin (BTC) and Ether (ETH).

Futures are contracts to buy or sell an asset at a set price on a future date, while options give traders the right, but not the obligation, to buy or sell those futures at predetermined prices.

The options contracts will cover standard and micro-sized SOL and XRP futures, with daily, monthly and quarterly expiries. The new derivative products are subject to regulatory approval.

https://www.youtube.com/watch?v=vB_U8wDOSE4

Giovanni Vicioso, CME’s global head of cryptocurrency products, said the expansion reflects “significant growth and increasing liquidity” in crypto futures markets. Vicioso expects the products to serve from “institutions to sophisticated, active, individual traders.”

According to Wednesday’s announcement, more than 540,000 SOL futures contracts ($22.3 billion in notional) have traded since launch in March, with August posting record activity of 9,000 contracts per day.

XRP futures have also gained traction since launching in May, with more than 370,000 contracts ($16.2 billion in notional) traded and record open interest of $942 million in August.

Related: XRP price rally stalls with $3 fakeout as big investors continue to sell

Altcoin futures gain ground in US markets

The first regulated crypto derivatives in the US debuted in December 2017, when the Chicago Board Options Exchange (Cboe) and the CME Group launched Bitcoin futures under Commodity Futures Trading Commission (CFTC) oversight.

The next significant milestone in the US came in 2021, when CME introduced Ether futures, followed by a series of micro contracts sized at 0.1 ETH. Until recently, however, regulated crypto derivatives in the US were mainly limited to Bitcoin and Ether.

With regulatory clarity from measures such as the GENIUS Act and a pro-crypto White House, demand for regulated crypto derivative products has been growing steadily.

That demand has been met by traditional exchanges as well as US-based fintech companies and crypto platforms.

In February, Coinbase introduced Solana (SOL) futures contracts in the US, including standard and “nano” contract sizes. The exchange later announced the acquisition of the options exchange Deribit.

Crypto exchange Kraken launched its derivatives arm in the country in July, and Robinhood rolled out micro futures contracts for Bitcoin, Solana and XRP through its derivatives arm.

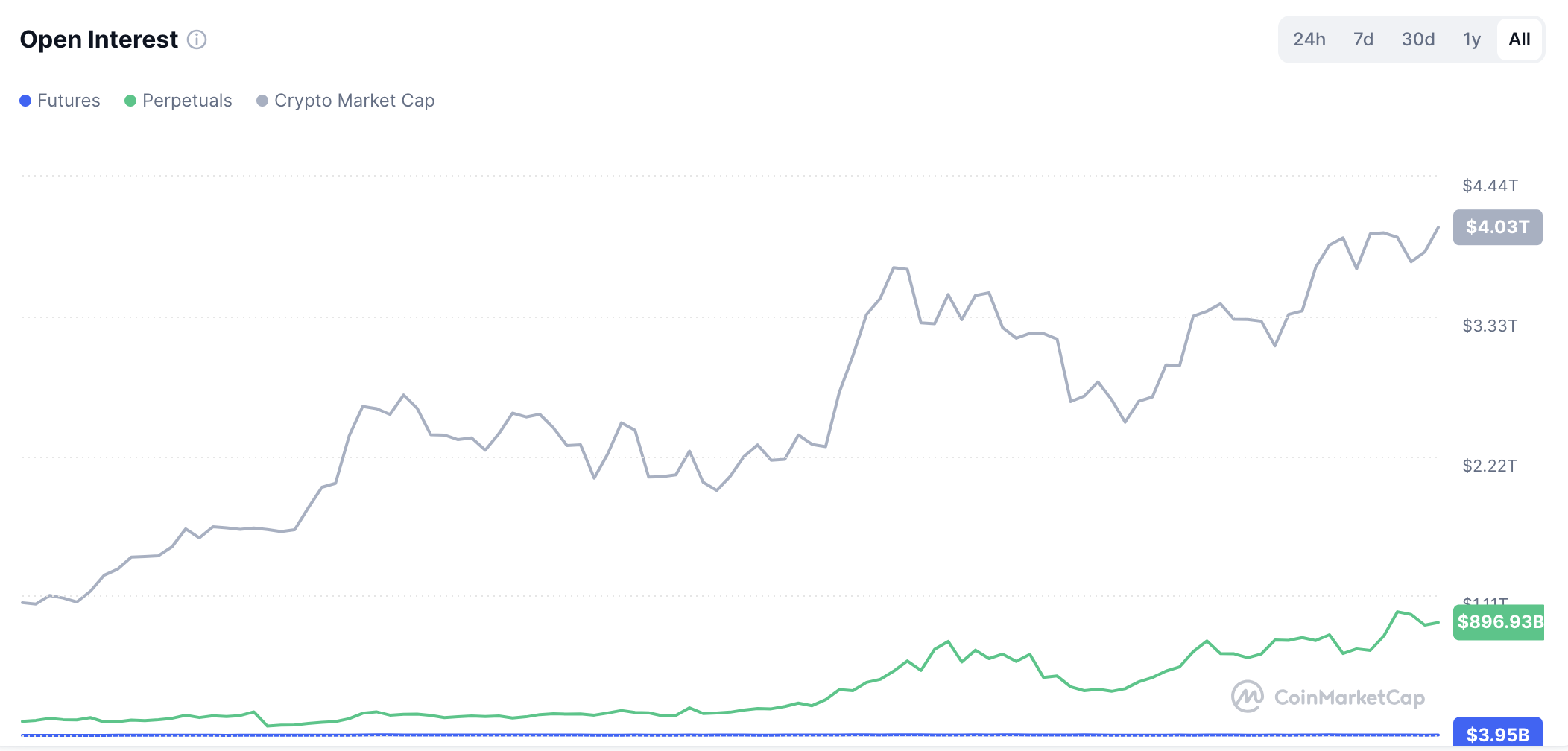

The surge of regulated offerings in the US comes as global crypto derivatives open interest holds near $4 billion, according to CoinMarketCap.

Magazine: Move to Portugal to become a crypto digital nomad — Everybody else is