Ethena Partners With Flowdesk as USDe Surges Past $14B

The rapid growth of the Ethena stablecoin ecosystem continued on Friday as Ethena Labs announced a partnership with institutional OTC desk Flowdesk, aimed at expanding access to its two tokens — USDe and USDtb.

Flowdesk, whose clients include token issuers, hedge funds and exchanges, will support trading and reward programs tied to both stablecoins, the companies said.

USDe is Ethena’s synthetic dollar, backed mainly by crypto assets and stabilized through a delta-neutral hedging strategy that keeps its value pegged to $1.

USDtb is backed by real-world assets — primarily BlackRock’s tokenized money market fund, BUIDL, and stablecoins — giving it a risk profile broadly comparable to fiat-backed stablecoins like USDC (USDC) and USDt (USDT).

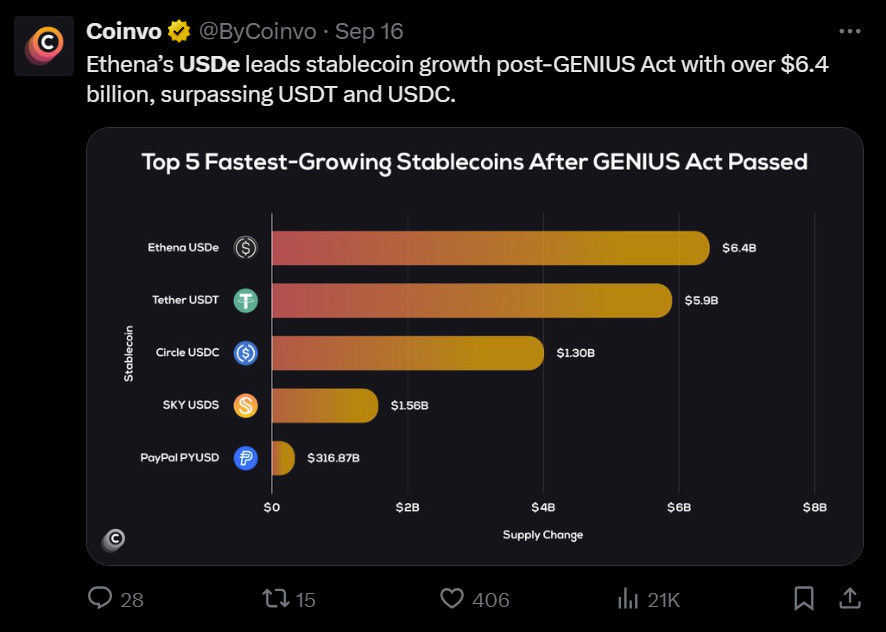

The announcement comes as USDe surpassed $14 billion in market capitalization, according to CoinMarketCap, with its circulating supply climbing 21% over the past month. That growth has propelled USDe into the position of the third-largest stablecoin by market cap, trailing only USDT and USDC.

Ethena ecosystem attracts public players

Ethena’s rapid growth has been fueled in part by USDe’s yield-generation model, which allows holders to earn returns while providing attractive collateral for decentralized finance markets.

That yield potential was a key factor behind Mega Matrix’s $2 billion shelf registration, giving the public holding company flexibility to acquire Ethena’s governance token, ENA. Owning ENA would allow Mega Matrix to participate in governance and capture revenue generated by USDe.

Ethena’s cumulative revenue surpassed $500 million in August, bringing the protocol closer to activating its anticipated “fee-switch” mechanism, which would distribute a share of protocol revenue to ENA holders.

Another soon-to-be public company is also eyeing Ethena. StablecoinX and TLGY Acquisition recently secured $890 million as part of a merger, with the new entity explicitly targeting acquisitions of digital assets — including ENA.

Despite its rapid growth, Ethena has been met with caution from market participants wary of derivatives-backed stablecoin models. Cointelegraph Research notes that synthetic stablecoins face funding rate volatility, since yields rely on positive funding rates, as well as counterparty risk and exposure to USDT-margined contracts.

The central question is whether synthetic dollars can remain resilient during extended periods of negative funding rates or prolonged stress in derivatives markets.

For now, USDe has defied those concerns, with demand continuing to climb as users appear willing to assume synthetic risk in exchange for yield.

Related: ‘Ethena has 6x upside to Circle’: Mega Matrix doubles down on ENA ecosystem