How decentralized identity could solve the double KYC problem

Connect by Persona introduces a decentralized, consent-based way for companies to reuse verified identity data across industries — uniting privacy, compliance and user control in one platform.

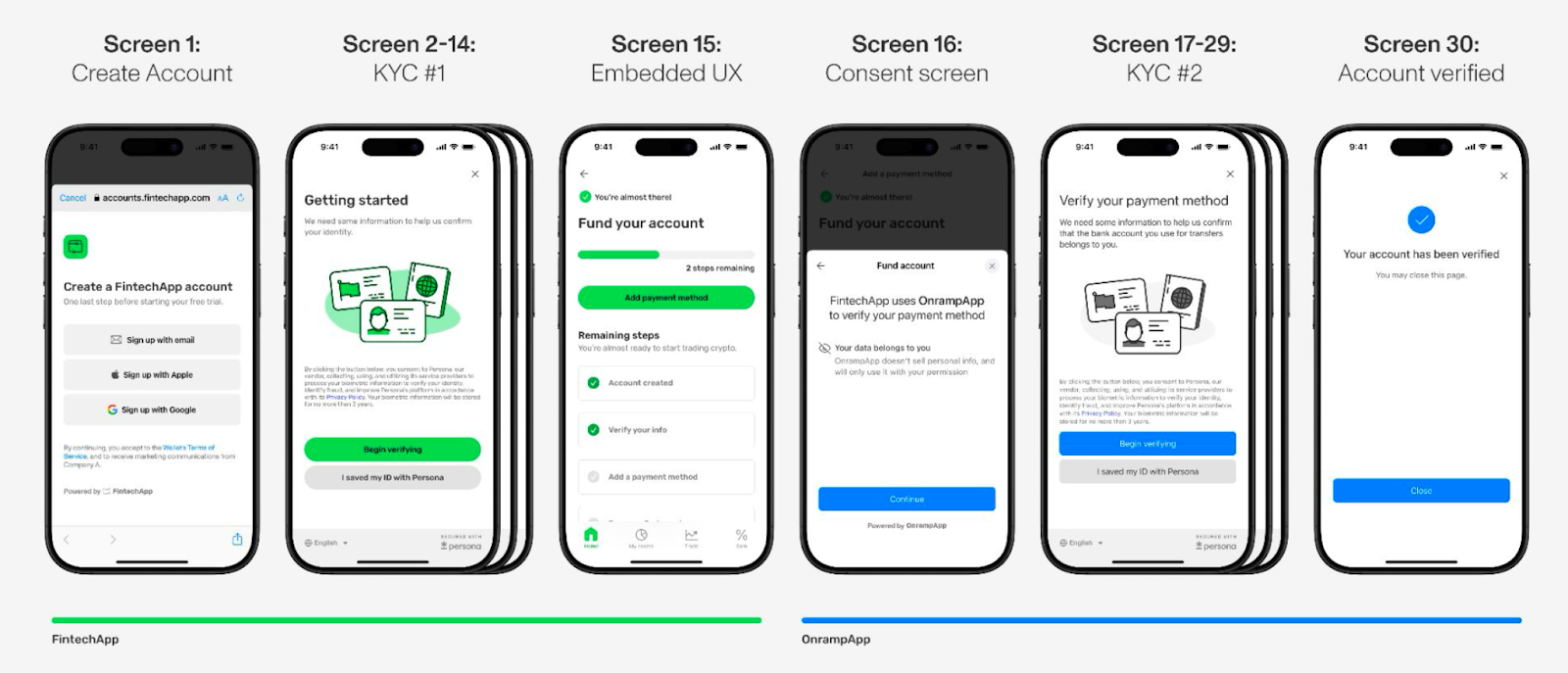

Identity verification has become both a necessity and a burden for users and businesses in finance and crypto. The same user might be asked for the same ID, selfie and proof of address again and again, especially with embedded applications like an on-ramp inside another app. These repetitive Know Your Customer (KYC) checks, designed to prevent fraud, have evolved into one of the industry’s biggest friction points.

While businesses see more customers give up midway, regulators struggle with disconnected systems that leave gaps in the data they rely on. Caught between growing fraud risks and tightening Anti-Money Laundering (AML) rules, institutions still find it difficult to balance compliance with user experience.

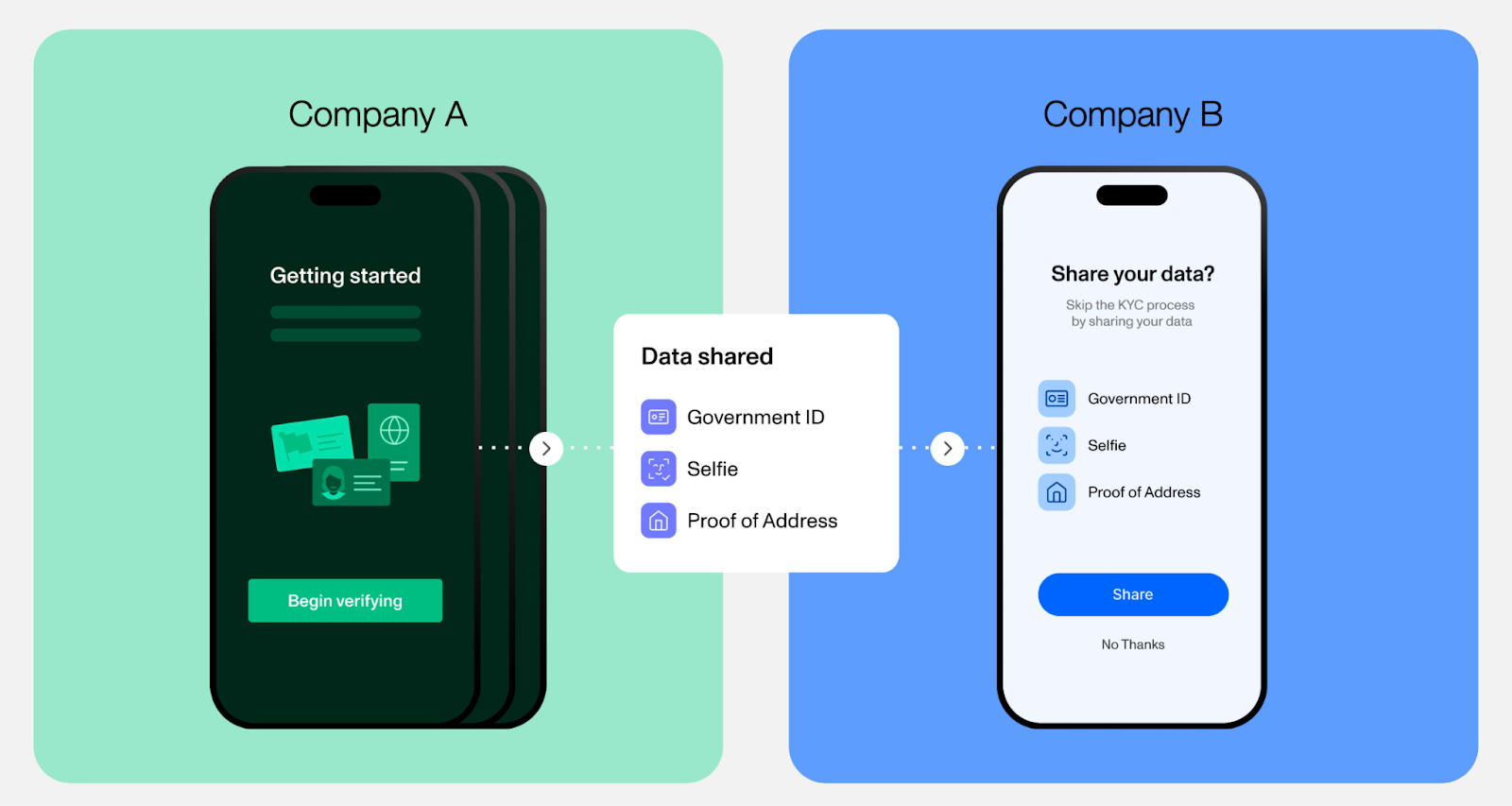

The industry has long sought a way to let companies securely reuse verified data instead of forcing customers through duplicative verification every time.

Connect, a platform that makes identity sharing secure, compliant and user-centric, aims to solve the so-called “double KYC” problem. Developed by Persona, a San Francisco-based identity verification company that provides KYC and AML automation tools, the platform lets organizations build their own consent-based networks for sharing verified identity and business data.

Users maintain ownership of their information, choosing when and where it can be reused. At the same time, businesses can eliminate unnecessary controls and streamline onboarding, while still meeting regulatory obligations.

Trust in digital identity through decentralization

Connect adopts a decentralized approach, unlike consortium-based systems that aggregate all identity information under a single sharing framework. Instead, organizations using Connect can design and govern their own data-sharing network, deciding what to share, when to reverify, and how to access records when required.

Through Persona’s Dashboard and application programming interfaces (APIs), companies can standardize these exchanges while keeping the technical setup light and avoiding the endless rounds of compliance back and forth that usually slow projects down.

Because each network is owned and operated by the organization itself, data sovereignty stays intact. Users decide when to give consent while companies retain control over their compliance logic and policies. In short, Connect makes privacy and interoperability work together instead of against each other.

Allowing users to bypass repetitive checks keeps onboarding simple and accessible. It’s no surprise that crypto became the first ecosystem to test this model. Early adopters like Coinflow are already planning to use Connect to speed up verification without weakening AML standards.

The success of these early pilots in crypto has also set the stage for a broader movement toward shared standards in identity verification.

Regulators are increasingly pushing for more coordinated identity sharing. FinCEN’s 2025 guidance, which urges financial institutions to share verified identity data securely and transparently, has been key to this shift. Connect meets both the technical and legal requirements of this new standard without eroding user trust.

Bridging crypto, fintech and TradFi

Persona will introduce Connect at Money20/20 USA in Las Vegas from October 27–30, 2025. The beta program already includes leading crypto infrastructure providers. Early access features like fraud signal sharing are in development, with support for additional data types on the roadmap.

Alongside its crypto initiatives, Persona will bring its technology to mainstream finance and fintech to help long-separated systems in banking and payments finally speak the same language. Over time, Connect aims to establish a universal framework for compliant data reuse: the rails upon which the next generation of digital identity can run.

This vision reimagines how identity works in a connected world. The modern approach to digital identity requires smarter bridges, not just stronger walls. When people switch between exchanges, wallets, or other platforms, their verified identity should move with them without extra steps.

Learn more about Connect

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.