Bitcoin Gives Traders a Wild Ride Into FOMC

Key points:

-

Bitcoin reaches $116,000 again as volatility ramps up into the US trading session.

-

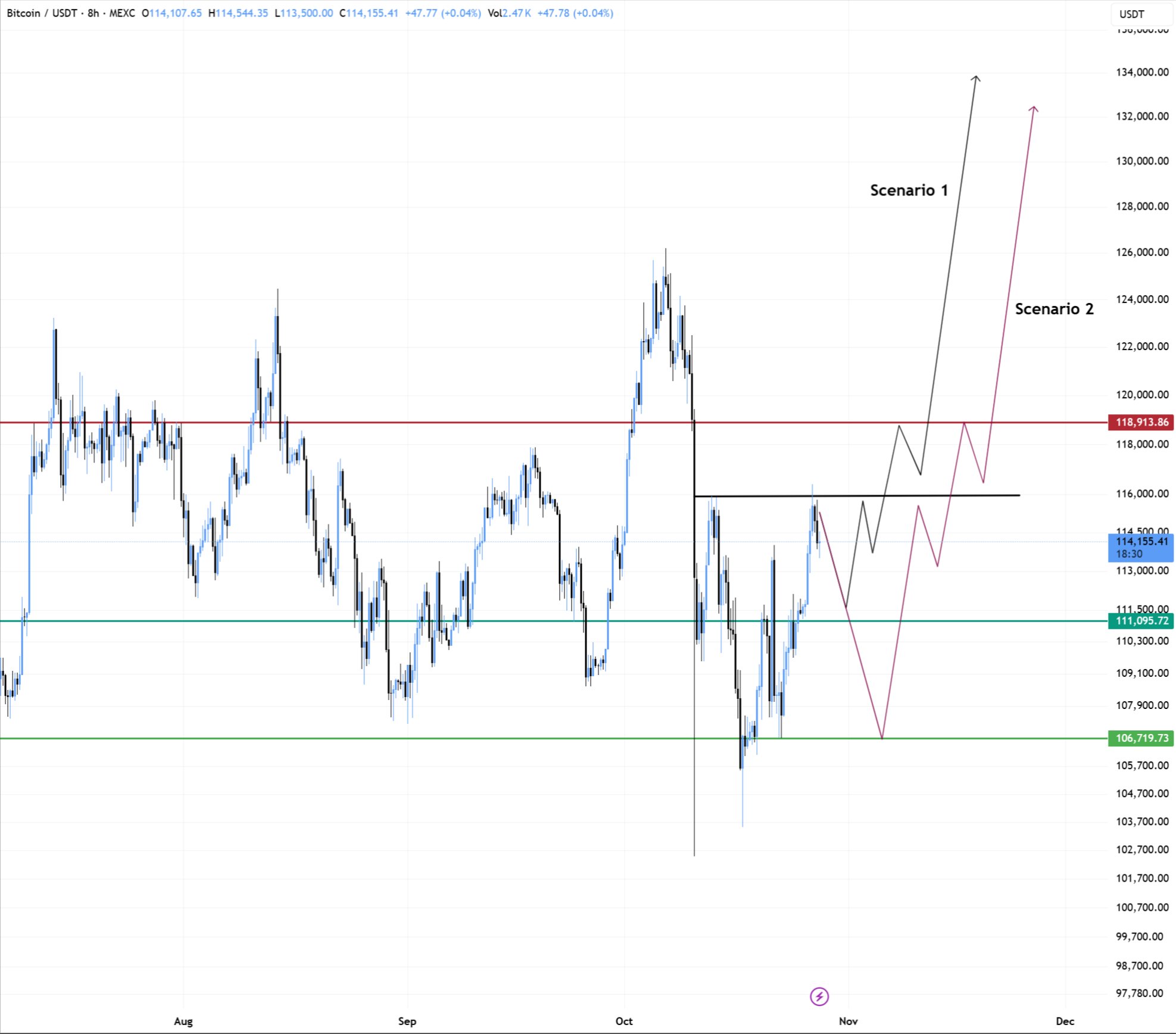

Traders diverge on short-term BTC price action, with targets including $117,000 before Wednesday’s Federal Reserve interest-rates decision.

-

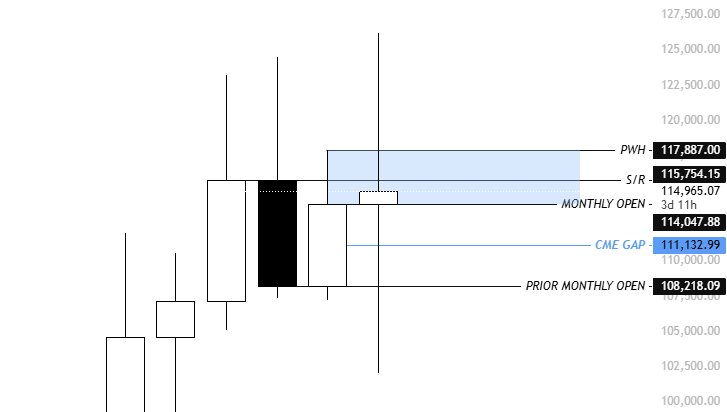

The latest CME futures gap gains popularity as a downside target.

Bitcoin (BTC) passed $116,000 after Tuesday’s Wall Street open as crypto refused to halt its Uptober comeback.

FOMC meeting injects BTC price volatility

Data from Cointelegraph Markets Pro and TradingView tracked 1.6% daily BTC price upside taking BTC/USD to $116,077 on Bitstamp.

In a move that traders found increasingly surprising, Bitcoin even bucked the trend of dropping prior to major US inflation events — in this case, the Federal Reserve interest-rates decision.

The Federal Open Market Committee (FOMC) was widely expected to cut rates by 0.25% Wednesday, with markets also watching Fed Chair Jerome Powell’s language for hints over future policy trajectory during the subsequent press conference.

“So far, so good on Bitcoin. It’s nicely holding up here and doing a slight retest after this crypto trader, analyst and entrepreneur Michaël van de Poppe reacted on X.

“I would assume that we’re bottoming here today and that we start the uptrend in the remainder of the week.”

In a separate post, Van de Poppe argued that an inverse correlation between Bitcoin and gold was helping fuel the uptick. The former dropped to $3,886 per ounce on the day, its lowest since Oct. 6.

“Gold coming down and consolidating is heavily bullish for risk-on assets, including Altcoins,” he wrote.

Trader Killa, meanwhile, had $117,000 in mind as part of a pre-FOMC local top before price returned lower to fill the latest weekend gap in CME Group’s Bitcoin futures market near $111,000.

Your welcome. My LTF plan playing out perfectly. Bullish narrative into FOMC. https://t.co/BIGR5q8kR9 pic.twitter.com/U2nsYJUrtv

— Killa (@KillaXBT) October 28, 2025

“CME gap as you can see is not that far away & I think breaking above this blue barrier is going to be a challenge,” he wrote.

“That said, we have a high chance of re-visiting 111.2K.”

$111,000 CME gap looms large

Many market perspectives still saw a BTC price dip at some point before the Fed event.

Related: Bitcoin ‘too expensive’ for retail, threatens to end bull market cycle

Trader BitBull flagged two areas of interest — $106,000 and $110,000 — before BTC/USD headed to new all-time highs.

“I’m still expecting the BTC top is not in, and there’s one big leg up left,” he told X followers.

As Cointelegraph reported, concerns over a lack of trading volume and bearish leading indicator divergences continue to raise doubts about whether the bull market can continue — or produce fresh all-time highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.