Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

In the lead-up to this week’s surprise listing of its Solana Staking ETF on the New York Stock Exchange, Bitwise CEO Hunter Horsley caused a stir by telling Cointelegraph that Solana’s shorter validator exit queue gave it the edge over Ethereum in the staking ETF race.

Bitwise chief investment officer Matt Houghan went much further on a podcast, praising Solana’s speed, throughput and finality as “extraordinarily attractive.” He labelled it “the new Wall Street.”

The glowing endorsements were controversial among Ethereum fans, some of who seemed to believe Bitwise was betraying ETH’s cypherpunk values by championing other projects.

Horsley was stung by the criticisms, not least because Ethereum was part of the inspiration for creating Bitwise in the first place.

He replied he felt “terrible to see these posts. We care a lot about Ethereum…. Feedback received re recent commentary seeming to be at odds with values in the ETH community. It’s being taken to heart.”

But does Bitwise actually hold cypherpunk values today? Would it launch an ETF for a blockchain that made little effort to be credibly neutral — say, to take a completely random example — a Tron ETF?

“We want to see everyone succeed,” Horsley says diplomatically, adding Bitwise would support any project with a credible team and a credible vision, and avoid any that don’t.

“It’s sometimes so funny to me when people get sort of so angry about competitors,” he says.

“I don’t think anyone would say that they wish that the iPhone was the only smartphone in the world and that all competitors disappeared and Apple had to compete with nobody.

“Monopolies are what users hate, so you know, I think it’s a real benefit that there’s competition because it drives improvement.”

Competition is certainly coming. Horsley reveals that Bitwise will take advantage of the SEC’s new generic listing standards with ETF applications for XRP, Avalanche, ChainLink, Hyperliquid, Aptos and Near.

Bitwise’s Solana ETF (BSOL) saw almost $56 million in volume on its first day, making it the strongest ETF launch of the year according to Bloomberg. Farside reported inflows of $69.5 million. (While it’s unusual to have inflows higher than volume, it does sometimes happen, especially when large institutional creation orders occur in the early days of an ETF.)

Sovereign wealth funds eye Bitcoin and Ethereum ETFs

Magazine catches up with Horsley in Singapore, shortly after his 45th flight this year. The globe-trotting exec explains that Bitwise Asset Management has been fielding interest from sovereign wealth funds.

“Oh, yes, yeah, more than one,” he says, but estimates it will take “three to six months” for their crypto ETF investments to land.

“The bigger the institution, the more consensus has to be developed, approvals, proposals, etc.”

The fact that a sovereign wealth fund is even talking to Bitwise is impressive, considering BlackRock dominates the Bitcoin and Ether ETF sector. But Bitwise has positioned itself as a crypto specialist firm amid a sea of TradFi issuers.

It seems to be working. Bitwise is in a very respectable fourth place among crypto ETF issuers, ahead of big names like Invesco, VanEck, Valkyrie and WisdomTree.

For crypto natives, part of the appeal is that it’s the only issuer to donate 10% of its profits to blockchain development.

Where did Bitwise come from?

The most amazing thing about Bitwise is that Horsley managed to get it funded in his mid-twenties — before he’d even had the idea for the crypto firm.

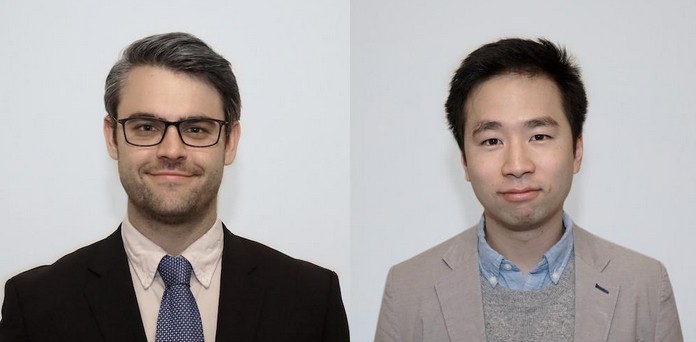

He was working as a product manager at Facebook and Instagram when an offer came in from investors willing to back whatever venture he and his college bestie, Hong Kim, came up with.

Horsley says it was a pretty major life decision to quit the hottest social media company in the world in November 2016.

“I felt even though I loved my job and felt very grateful to have it that I would regret not walking through that door even if it was treachery on the other side,” he says.

He accepted the offer and the pair rented an apartment to work from, above a tie-dye shop in San Francisco’s Haight Ashbury, “surrounded on both sides by tattoo parlors.”

“Then we set to work on figuring out what in the world we wanted to do,” he says.

Horsley had bought Bitcoin a few years earlier, but it was the city’s embrace of Ethereum that year that gave them the idea for Bitwise.

“A lot of people were thinking about and talking about it,” he says, noting the decentralized, trustless tech appealed to the anti-establishment culture.

“I think that inherent in crypto is a proposition that the world could operate in a way that is better than how it operates today. And so I think that’s almost definitionally, indeed, countercultural.”

Bitwise launched the world’s first crypto index fund, the Bitwise 10, the following year. Investors in the firm included former Twitter vice president Elad Gil and Y Combinator partner Avichal Garg. AngelList co-founder Naval Ravikant told Forbes in 2017 that he saw enormous potential in the pair of twenty-somethings, despite their complete lack of experience in either crypto or TradFi.

“I think they’re top-notch entrepreneurs. I’ve been circling them as a team for a while. As an early stage investor, I bet on teams that are unproven,” he says. “If a bunch of stodgy guys from JPMorgan were to walk in and say they were doing this, I probably wouldn’t invest in them.”

Initially launched as a private fund, the Bitwise 10 opened to the public in 2020, and currently has $1.5 billion in AUM.

Bitwise has now grown to have 120 staff and 30 different products and services, including ETPs in Europe and a dozen crypto-related ETFs in the US. It also offers yield, options, hedge fund strategies and stakes several billion dollars of crypto for clients while running validators and data centers.

Read also

Horsley’s early life and work at Facebook

Horsley grew up in Menlo Park in the Bay Area. He attended the Wharton Undergraduate School of Business. A formative influence on his life was a class called the History of Business in America, which examined primary sources from historic events, like the first annual report to use the concept of variable costs or “the press release that Ford Motors put out when Henry Ford doubled the minimum wage.”

His first job out of school was at an education startup called CourseKit, acquired by Noodle in 2013.

Horsley joined Facebook in 2014, where he worked on both Groups and video ads across Facebook and Instagram. This was back when it was cool and exciting and long before Facebook turned into what Horsley describes as “a total dumpster.”

One lesson he learned was the importance of avoiding lofty mission statements. He explains Facebook’s stated mission to “make the world more open and connected” was sometimes “at odds” with what its users actually wanted, such as its dubious decision to make all uploaded photos public by default.

If the mission was to look after users, he argues Facebook would have set it to private, but “if your mission is to make the world more open and connected, you probably flip them to public to the whole world,” he says.

“I am very, at Bitwise, very anti-mission. Bitwise’s mission is for clients to love us and to be useful and valuable… We don’t have some other mission. And that’s a direct result of my time at Facebook.”

Working on Facebook Groups also taught him the value of genuine digital ownership. Horsley explains these Groups often became “immensely important to people” because they brought together very niche interests, or those who shared a medical condition.

But every day, people would be arbitrarily thrown out of groups over minor disagreements with admins.

“One of the things that was sort of fascinating to me … there are digital things that are really important to people, but you don’t have property rights, you don’t have courts, you can’t call the police when the admin kicks you out of the group. But it does matter.”

A case in point: crypto influencer Kyle Chasse told Magazine this week that YouTube has threatened to ban his 171,000 subscriber channel and delist his 1,300 videos without even telling him which rule he broke.

Read also

“There are communities that you’re part of digitally, things you want to do together digitally that are hugely important. But there are not good systems for how people will coordinate,” he explains.

This helped him understand the value of “consensus mechanisms and public blockchains, which are systems of coordination, adjudication, and rules of the road for people to be members, or contributors, or owners of things.”

Getting Matt Houghan on board Bitwise

One big factor that’s enabled Bitwise to compete with the big ETF issuers is CIO Matt Houghan, formerly the CEO of ETF.com and Inside ETFs.

Horsley recalls he arranged a meeting to try to convince Houghan to invest in Bitwise, but switched tack after Houghan proved unusually enthusiastic.

“At the end of the meeting, I slightly modified my question from ‘would you be interested in investing in this company?’ to ‘would you be interested in investing in this company or even being part of this company?’ And he didn’t flinch or throw me out of the room.”

It took several months, but Houghan joined as CIO in 2018.

While they discussed the prospect of launching Bitcoin and other crypto ETFs at that meeting, it wasn’t the primary reason he joined. Which was good, as it took six more years for the first Bitcoin ETF to launch. Horsley explains the crypto world and the ETF worlds have more in common than people think.

“The ETF world was a financial technology innovation that was originally dismissed for reasons that actually sound quite similar to crypto,” Horsley says, of the emergence of the products in the 1990s.

“I think this is a reason that ETF people in general have really engaged with crypto, maybe more so than any other part [of finance],” he says.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with more than 25 years experience, who has been covering cryptocurrency since 2018. He spent a decade working for News Corp Australia, first as a film journalist with The Advertiser in Adelaide, then as Deputy Editor and entertainment writer in Melbourne for the nationally syndicated entertainment lift-outs Hit and Switched on, published in the Herald-Sun, Daily Telegraph and Courier Mail.

His work saw him cover the Oscars and Golden Globes and interview some of the world’s biggest stars including Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Prior to that he worked as a journalist with Melbourne Weekly Magazine and The Melbourne Times where he won FCN Best Feature Story twice. His freelance work has been published by CNN International, Independent Reserve, Escape and Adventure.com.

He holds a degree in Journalism from RMIT and a Bachelor of Letters from the University of Melbourne. His portfolio includes ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.