Without Bitcoin, What Happens to Ether and XRP?

Key takeaways:

-

A sharp Bitcoin decline often triggers systemic contagion, driving altcoins lower through both liquidity and confidence channels.

-

During crises, the market tends to view crypto as a single risk asset rather than valuing individual utility, as seen in the high BTC-ETH and BTC-XRP correlations.

-

Correlation and beta analyses are essential for quantifying how deeply Ether and XRP depend on Bitcoin’s performance.

-

Monitoring correlation indicators, using derivatives and maintaining stable or yield-bearing assets can help hedge against Bitcoin-related shocks.

The dominance of Bitcoin (BTC) in the cryptocurrency market has long been the defining feature of crypto cycles. But what happens if Bitcoin’s dominance fades or its price plunges by 50%? In that scenario, two of the largest coins, Ether (ETH) and XRP (XRP), become critical test cases for how the market reshuffles.

This article explains how to evaluate ETH and XRP during a Bitcoin shock, measuring dependence, assessing risk and devising effective hedging strategies.

Why Bitcoin dominance matters

In traditional equity markets, when the biggest player in a sector stumbles, the ripple effects are immediate. Smaller firms often lose value as they depend on the leader’s ecosystem, investor confidence, supply-chain links and reputation. The same logic applies to crypto: Bitcoin serves as the “anchor asset.” When Bitcoin weakens, the entire market loses its sense of stability and direction.

Historically, Bitcoin has held a large share of the crypto market’s capitalization, known as the “dominance” metric. Most altcoins, including Ether and XRP, have shown a strong correlation with Bitcoin’s price movements.

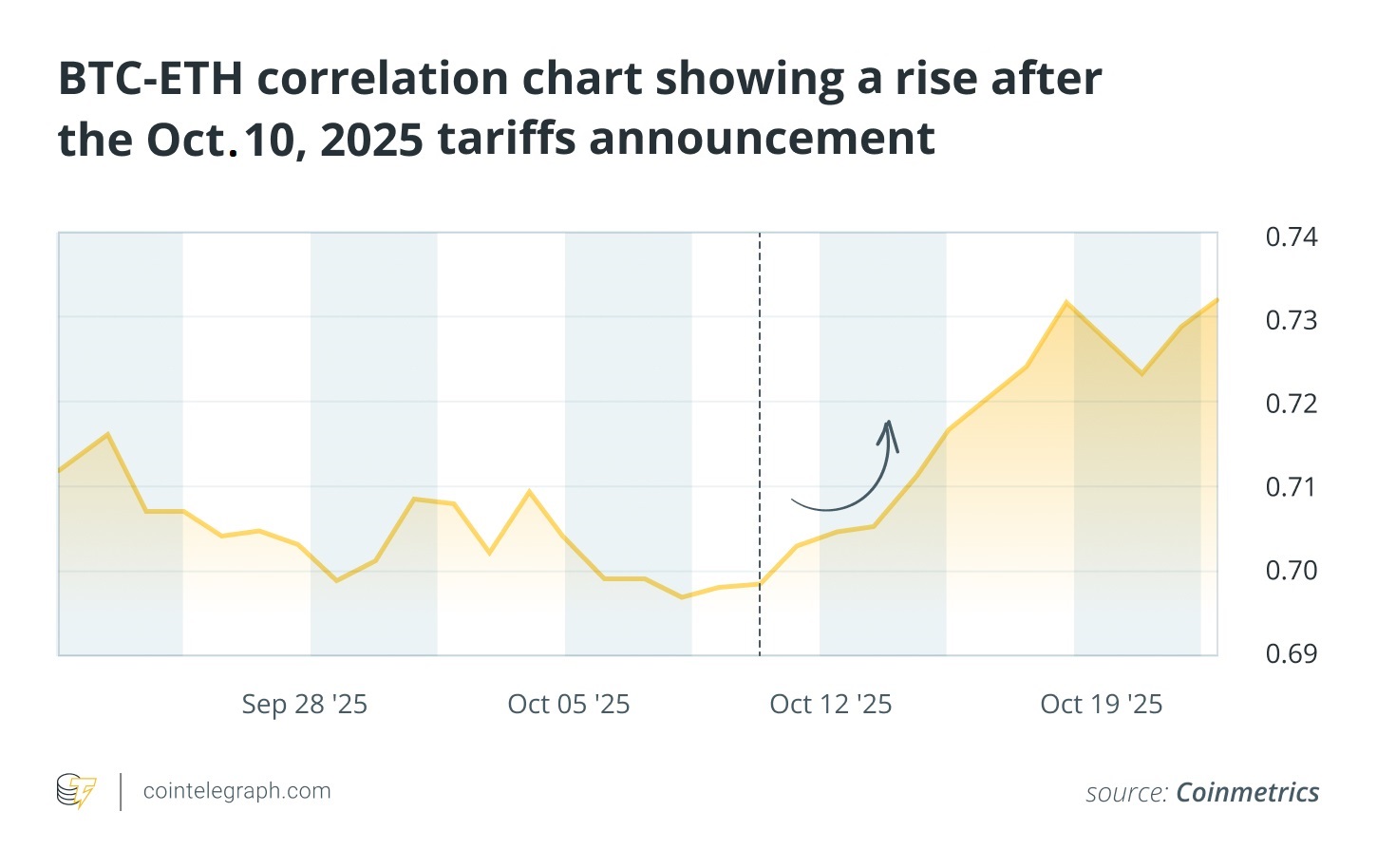

For example, following the Oct. 10, 2025, tariff announcement, the crypto market experienced a broad liquidation event, with Bitcoin falling sharply. According to CoinMetrics, the BTC-ETH correlation rose from 0.69 to 0.73, while the BTC-XRP correlation increased from 0.75 to 0.77 over the next eight days.

This sharp convergence confirms that during a liquidity crisis driven by macroeconomic fear, altcoins don’t decouple based on their individual utility. Metrics such as Ether’s transaction volume or XRP’s institutional adoption offer little protection in such scenarios.

Instead, the high positive correlation serves as an empirical measure of shared systemic risk. It shows that the market views the entire crypto sector as a single asset class. This amplifies the downstream effects of a BTC-led collapse on ETH and XRP.

The implication is clear: If Bitcoin’s dominance drops or its price collapses, ETH and XRP are unlikely to move independently. They would likely suffer through two channels:

Liquidity/structural channel

Market structure, including derivatives, exchange flows and investor behavior tied to BTC, weakens. A major Bitcoin crash could trigger large-scale liquidations driven by margin calls and cascading sell-offs. This often leads to massive capital outflows that hit all crypto assets, regardless of their fundamentals. They fall simply because they share the same risk basket.

Sentiment channel

A breakdown of the original decentralized asset undermines the core thesis of the entire crypto industry. It erodes investor confidence in the long-term viability of cryptocurrencies. As fear takes hold, investors tend to move toward safer assets such as fiat or gold. The result is a prolonged bear market that weakens investment appetite for both Ether and XRP.

How to measure Bitcoin dependence and risk

Step 1: Define the shock scenario

The analysis begins by selecting a plausible, high-impact Bitcoin event. This could involve defining a specific price shock, such as a 50% BTC drop within 30 days, or a structural shift, for example, Bitcoin’s dominance falling from 60% to 40%.

Step 2: Quantify dependence

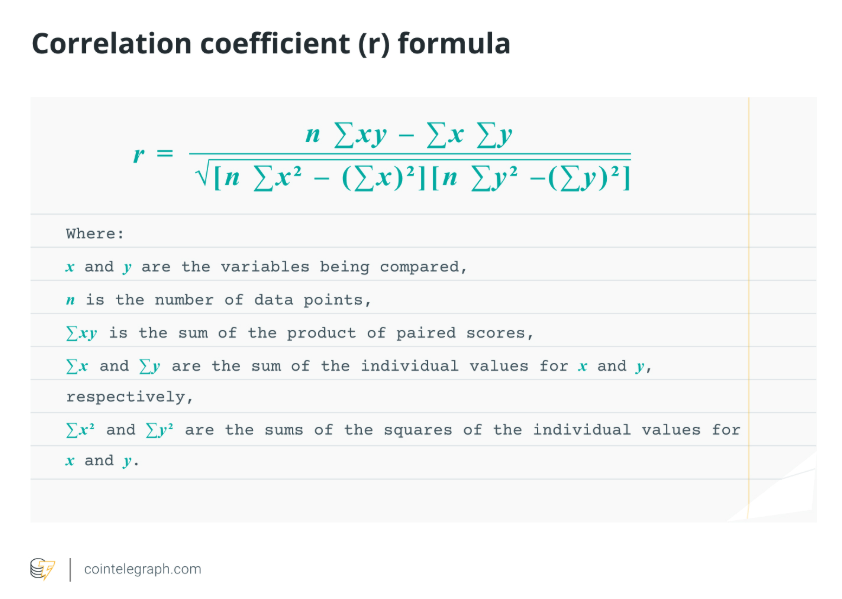

The next step is to calculate the current Pearson correlation coefficient between ETH, XRP and BTC. This statistical measure captures the linear relationship between the assets’ daily returns, providing a baseline for dependence. A value closer to +1 indicates that the altcoin is strongly tied to BTC’s performance.

Step 3: Estimate immediate price response

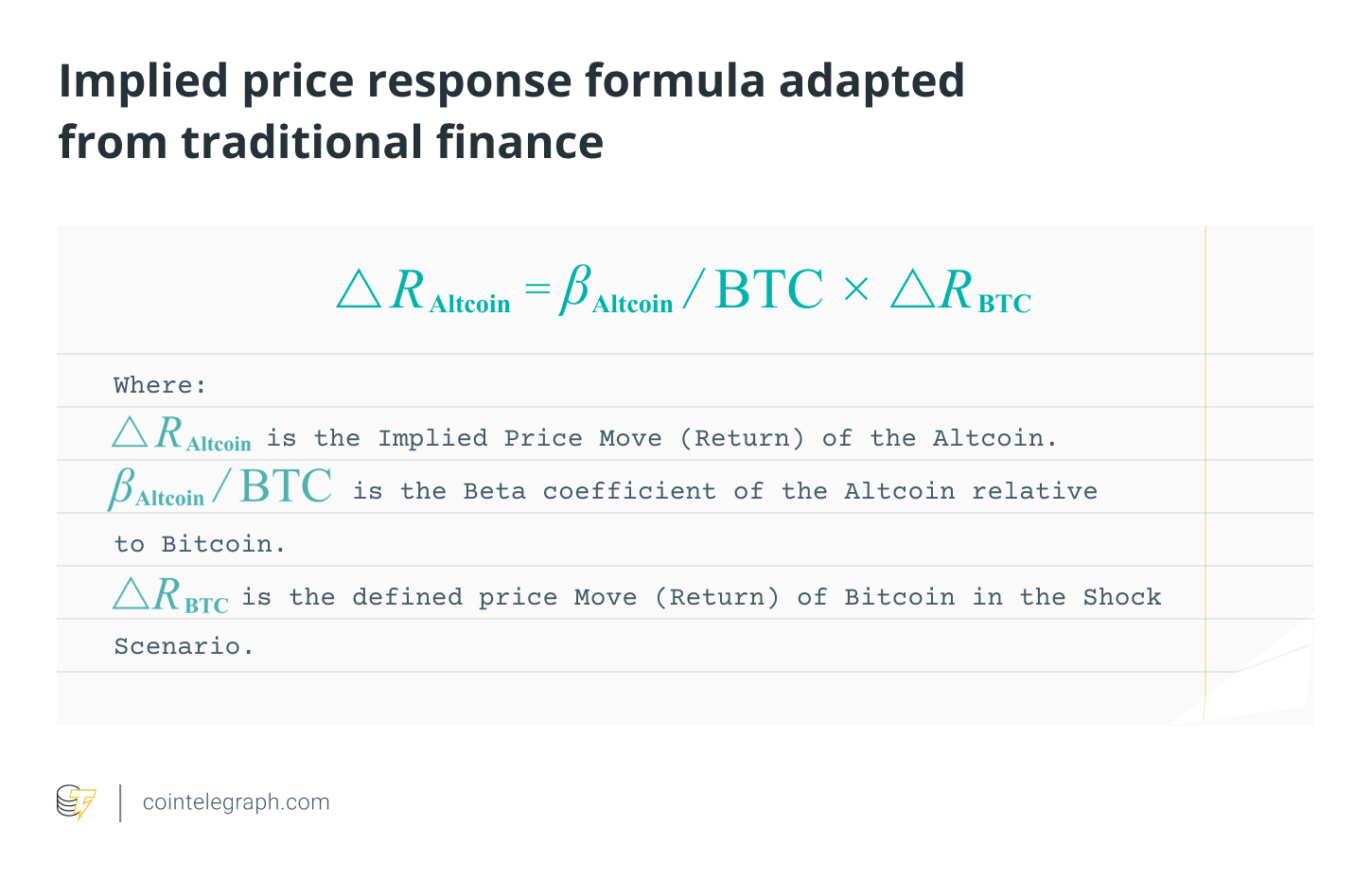

Using correlation data, apply regression analysis to calculate each altcoin’s beta (β) relative to BTC. The beta coefficient estimates the expected price movement of the altcoin for every one-unit change in Bitcoin. This is similar to calculating a stock’s beta relative to a benchmark index like the S&P 500 in traditional finance.

For example, if ETH’s β to BTC is 1.1 and the defined scenario assumes a 50% drop in BTC, the implied ETH move would be -55% (1.1 × -50%).

Step 4: Adjust for liquidity and structural risk

Adjustment requires going beyond the simple beta calculation by factoring in key market structure risks. Thin exchange order books should be analyzed to account for liquidity risk, while high derivatives open interest must be assessed for structural risk and potential cascading liquidations.

For instance, if the implied -55% move from Step 3 is compounded by shallow liquidity, the actual realized loss could increase by another 10%, resulting in a total -65% drop. Additionally, review open interest and margin positions, since high leverage can accelerate the decline through cascading liquidations.

What happens to Ether and XRP in a Bitcoin shock scenario?

In traditional finance, a sharp sell-off in the S&P 500 or the sudden collapse of a major broker often triggers a rapid, indiscriminate flight to safety — an effect known as “financial contagion.” The cryptocurrency market exhibits a similar dynamic, but in a faster and often more amplified form, typically sparked by a Bitcoin-centered shock.

Data from previous crises, including the FTX and Terra collapses, reveal a clear pattern: When Bitcoin falls, altcoins are typically dragged down with it. Bitcoin continues to serve as the market’s primary risk indicator.

In such a scenario, liquidity often rushes into stablecoins or exits the market entirely in search of protection from volatile assets. Although Ether benefits from robust layer-1 utility, it is not immune; during market stress, its correlation with Bitcoin often increases, as institutional capital treats both as risk assets. However, Ether’s staking lock-up and broad decentralized application ecosystem may provide a utility-driven floor, potentially helping it rebound more rapidly once the crisis subsides.

Assets such as XRP, on the other hand, which face higher regulatory and structural risks and lack Ether’s extensive, organic onchain yield mechanisms, could be hit disproportionately. Such shocks often trigger a vicious cycle in which collective loss of confidence outweighs fundamental token utility, driving a correlated market-wide decline.

Did you know? While Bitcoin is typically uncorrelated with the S&P 500, during periods of extreme financial stress — such as the COVID-19 pandemic — its correlation with the equity index tends to tighten significantly.

How to hedge your strategy if BTC loses dominance or its price falls

Hedging a crypto portfolio against a sharp Bitcoin decline requires more than basic diversification. Systemic shocks have shown that extreme correlations often erase the benefits of spreading risk.

Explore derivatives

During periods of extreme panic, the futures market can trade at a steep discount to the spot price. This creates opportunities for sophisticated traders to pursue relatively low-risk, non-directional arbitrage. In doing so, they exploit market inefficiencies as a hedge against volatility rather than taking directional price exposure.

Diversify your portfolio with risk buffers

Hold positions in tokenized gold, real-world assets (RWAs) or fiat-backed stablecoins to preserve portfolio value. These assets act as liquidity reserves when crypto markets spiral downward.

Monitor dominance and correlation ratios

Tracking the rolling short-term correlation of ETH and XRP to BTC can serve as a real-time warning signal that diversification benefits are disappearing. It confirms when immediate hedging action may be necessary.

Rebalance to yield-bearing positions

Shift part of your holdings into staking, lending or liquidity pools that generate yield regardless of market direction. The steady yield can help offset valuation losses and improve recovery potential.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.